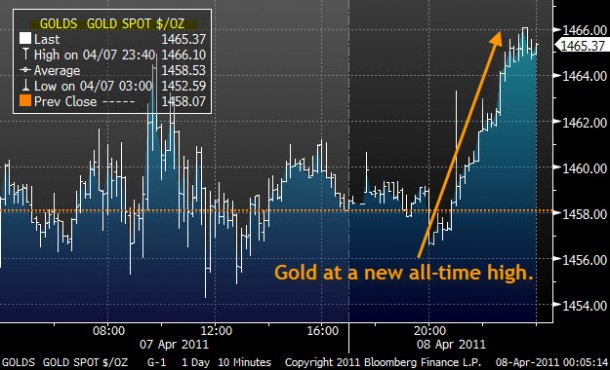

Between the inability of Fed Chairman Bernanke to see (or given in to) the fact that there is inflation and Government’s incompetence, the dollar is being sold with fervor.

While the EuroZone struggles to bailout Portugal, Greece, Italy, Ireland etc., the Euro is strong as compared to the U.S. dollar. That has the risk trade ON and liquidity is flowing into any asset (other than the dollar).

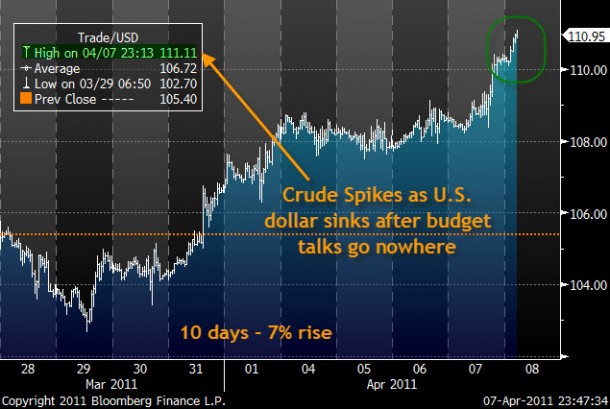

Just look at what happened when the meetings over the budget ground to a halt last night. The dollar plunged and markets around the world exploded to the upside. Even after the Nikkei futures pointed to an open off by almost 1%, equities came roaring back on the heels of cheap money getting cheaper by the tick.

Not even a debilitating earthquake, sovereign debt crisis or Chines rate hikes matter. All trading starts and stops with the dollar these days.