Yowser. Was that something or what? Due t0 its popularity, the Velocity Shares VIX product (TVIX) had halted creation of new shares a few weeks back. That is where the trouble started. With that move, there was an ever growing premium as investors continued to buy shares in an attempt to hedge out some portfolio risk. Needless to say, that plan did not work out so well.

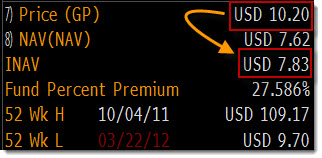

Even with 30% drop today, there continues to be whopping premium still embedded this particular ETF.

TVIX Defined:

VelocityShares Daily 2x VIX Short Term ETN is an exchange-traded note issued in the USA. The Note will provide investors with a cash payment at the scheduled maturity or early redemption based on 2X the performance of the underlying index, the S&P 500 VIX Short-Term Futures Index less the Investor Fee.

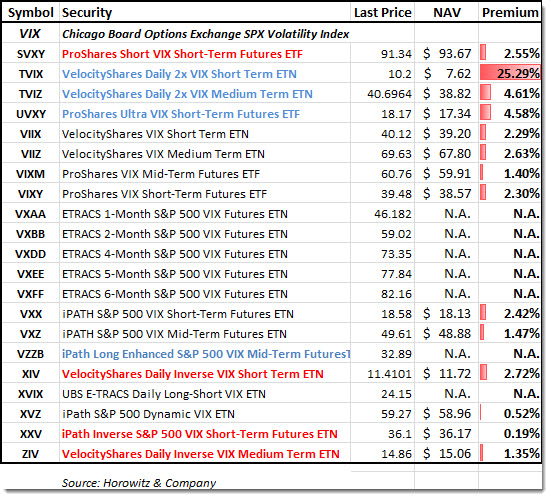

Here is a list of ETFs and their respective premium of price to Indicative NAV:

In other words, when looking at the table above, the amount of the premium is the difference between the NAV of the ETF, and the actual price. Looking at TVIX, there is still a potential premium of 25% over the price as compared to the last traded value.

Now, look at what has occurred over the past month to the spread of NAV to Price for TVIX:

(Click to enlarge)

Since the fund stopped issuing shares at the beginning of March, there was a consistent widening of the spread as any buying simply moved up the price without a corresponding addition to the NAV. In other words, the law of supply and demand; rather than the underlying “true” value accelerated. Once Velocity Shares was rumored to begin issuing shares again, the premium bubble burst. More from Bloomberg:

The gap between the security‘s price and the value of the index it tracks has widened since Credit Suisse suspended issuance of new shares, causing a supply shortage amid record demand for volatility products that provide a hedge against U.S. equity losses. Short sellers may be accelerating bets against TVIX today on speculation Credit Suisse will permit issuance of more shares, said Wallach Beth Capital‘s Chris Hempstead.

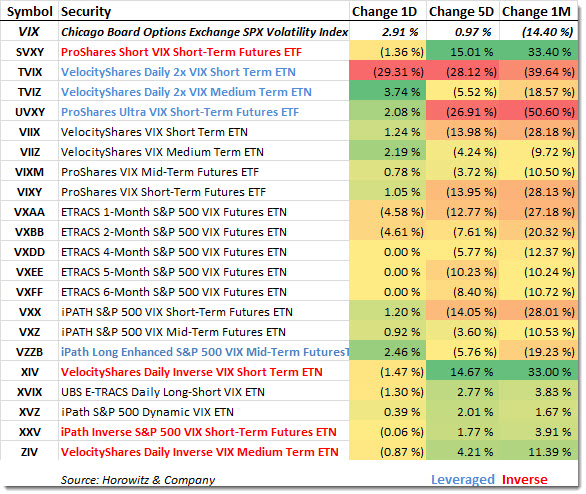

The 1-Day, 5-Day and 1-month returns of some of the more popular VIX ETFs:

On several recent TDI Podcasts, we discussed and warned about the inherit problems with VIX ETFs and made mention that they are only short term trading instruments that have to be watched. Today’s implosion is one of the reasons why it is important to know the product you are investing in. In other words, don’t simply judge a book by its cover.

Here is a great reference piece on VIX ETFs – CLICK HERE (pdf)

We have used the TVIX as a hedging vehicle for TDIMG portfolios in the past and had a 5% position coming into the open on Thursday. Fortunately we saw that something was not quite right early on and exited the position while the shares were still trading well above $13.50 +/-.

It would appear that the lawyers will take over now. There is going to be repercussions and perhaps we will finally see the end of crappy ETF construction for a while… (well at least I can dream!)