So, what did you think Bernanke would say? Obviously with the current state of the economy and the low level of inflation (from the Fed’s view) there is going to be a continuation of the “extended period” for an extended period. This gave the green-light to traders as they were quick to snap up precious metals and other commodities.

(A side-by-side comparison of the last two Fed minutes is HERE)

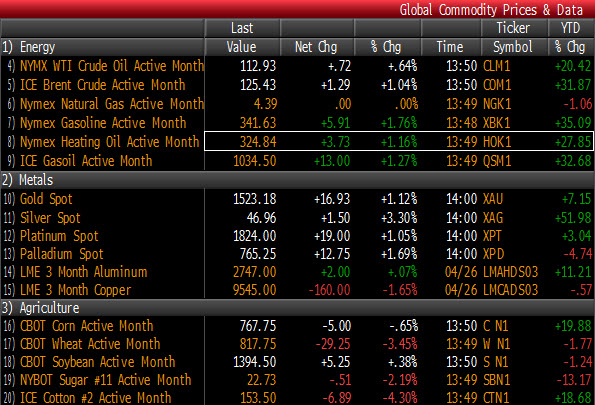

Silver went bananas and there was a small bounce higher for equity markets. Of course the dollar got smacked against the Euro and other currencies. Crude is now resting comfortably at $113.40 per barrel and gold is at a new record.

The Dollar index sold off after the 12:30 announcement

Commodities have reacted favorably to the news. Of course the Fed believes that there is no material correlation to their stance and the price of commodities. Nah.. It is just supply and demand, right? I mean to say that it was just a coincidence that at the exact moment that the statement was released, major demand came in to the market for additional oil…

From Briefing.com

Information received since the Federal Open Market Committee met in March indicates that the economic recovery is proceeding at a moderate pace and overall conditions in the labor market are improving gradually. Household spending and business investment in equipment and software continue to expand. However, investment in nonresidential structures is still weak, and the housing sector continues to be depressed. Commodity prices have risen significantly since last summer, and concerns about global supplies of crude oil have contributed to a further increase in oil prices since met in March. Inflation has picked up in recent months, but longer-term inflation expectations have remained stable and measures of underlying inflation are still subdued.

The unemployment rate remains elevated, and measures of underlying inflation continue to be somewhat low, relative to levels that the Committee judges to be consistent, over the longer run, with its dual mandate. Increases in the prices of energy and other commodities have pushed up inflation in recent months. The FOMC expects these effects to be transitory, but it will pay close attention to the evolution of inflation and inflation expectations. The FOMC continues to anticipate a gradual return to higher levels of resource utilization in a context of price stability. To promote a stronger pace of economic recovery and to help ensure that inflation, over time, is at levels consistent with its mandate, the Committee decided today to continue expanding its holdings of securities as announced in November. In particular, FOMC is maintaining its existing policy of reinvesting principal payments from its securities holdings and will complete purchases of $600 bln of longer-term Treasury securities by the end of the current quarter. The Committee will regularly review the size and composition of its securities holdings in light of incoming information and is prepared to adjust those holdings as needed to best foster maximum employment and price stability. The FOMC will maintain the target range for the federal funds rate at 0.00-0.25% and continues to anticipate that economic conditions, including low rates of resource utilization, subdued inflation trends, and stable inflation expectations, are likely to warrant exceptionally low levels for the federal funds rate for an extended period. The Committee will continue to monitor the economic outlook and financial developments and will employ its policy tools as necessary to support the economic recovery and to help ensure that inflation, over time, is at levels consistent with its mandate.

___