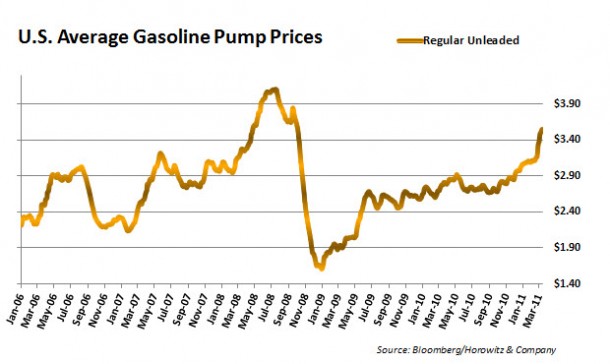

The disaster in Japan has created a situation that may cause a drop in oil and other energy use – at least that is what the talking heads will believe. Yet, there is nothing correct about that as Japan will need to switch from nuclear energy to fossil fuels for some time to come. The main reason that oil dropped was primarily due to the concern over supply related the uprisings in the Middle-East.

With last Friday’s “Day of Rage” in Saudi Arabia fizzling out, those traders who had big bets that it would cause a shutdown of OPEC related supply were sideswiped. Bets were taken off of the table quickly, dropping the price of oil quickly.

Add to that the earthquake in Japan and a glut of inventories and the result was a quick drop. But will that continue or is oil above $100 here to stay?

Above, mid-day Wednesday, March 16 2011 – (WTI finished the day on Wednesday at $98.23)

Above, mid-day Wednesday, March 16 2011 – (WTI finished the day on Wednesday at $98.23)

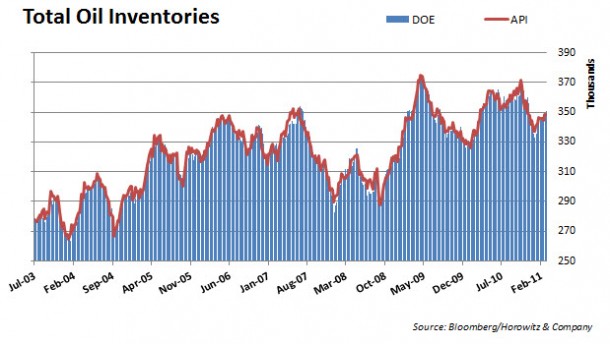

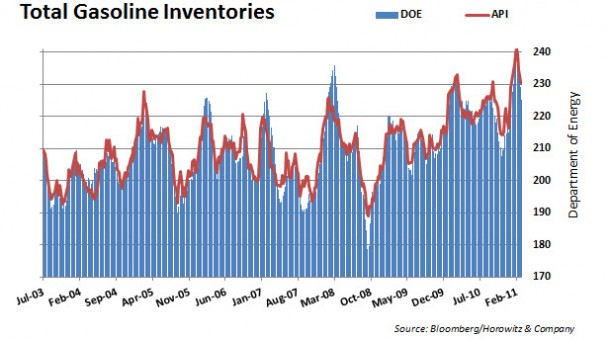

The recent inventories from the DOE showed:

Dept of Energy reports that:

- Crude oil inventories had a build of 1745K (consensus is a build of 1300K)

- Distillate inventories had a draw of 2601K (consensus is a draw of 1400K)

- Gasoline inventories had a draw of 4174K (consensus is a draw of 1500K)

- The change in refinery utilization was 1.4% (consensus is 0.00%)

Clearly this was taken as a bullish signal for gasoline, slightly bearish for oil. More importantly, the total inventories are still at high levels. Even so, panic is overtaking good judgement.

Oil inventories are down of late, but still much higher than the average over the past few years.

Look at the levels of gasoline. There is no reason that there should be any panic over draw-downs…yet.

So, it seems that oil is still over-priced at this level when considering the inventories and usage. Somewhere between a $5-$10 panic premium appears to be embedded in the current price.