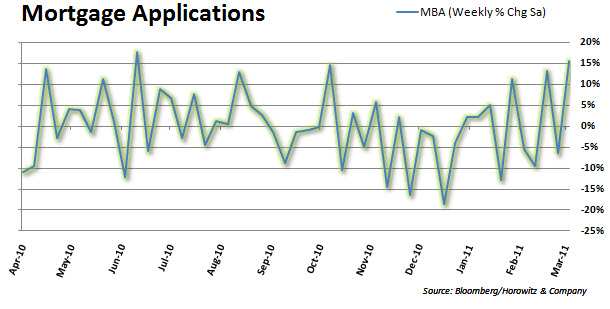

Turning a Corner? That may be a bit over-optimistic. Yes, we are seeing a better mortgage applications this week, but that is on the heels of a negative week. Remember this is a very noisy series in that it is weekly based.

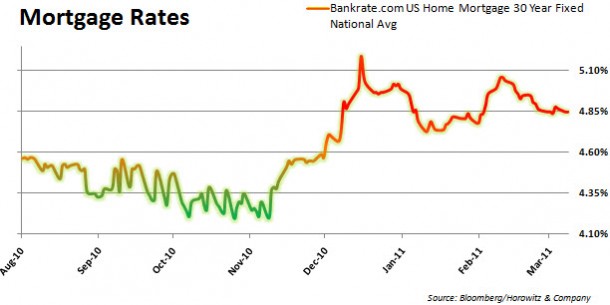

Perhaps there was a rush to apply for both new mortgages and refinancing as rates have been drifting lower after a significant spike in the first couple of months in 2011.

Note that since January, rates have slipped by approximately .25%. Still, the recent rise after the QE2 put many on notice that this may be some of the lowest rates that they may see for some time. That surely provided impetus for some to get in gear and refinance ASAP.

Note that since January, rates have slipped by approximately .25%. Still, the recent rise after the QE2 put many on notice that this may be some of the lowest rates that they may see for some time. That surely provided impetus for some to get in gear and refinance ASAP.

From Econoday.com

From Econoday.com

One week’s data is only one week’s data but the Mortgage Bankers Association believes improvement in the jobs market is “beginning to pave the way” for improvement in the housing market. MBA’s purchase index, which measures volume of mortgage applications for home purchases, surged 12.5 percent in the March 4 week for its best reading of the year. Rates remain favorable, at 4.93 percent for 30-year loans. The refinancing index also revived in the week, up 17.2 percent for its best reading since mid-January.