T he Great Recession has provided for an unusually high level of unemployment that is not expected to show signs of normalization for years. In fact, several studies have shown that to reach pre-recession levels would require an additional 17 years at the estimated rate of job growth.

he Great Recession has provided for an unusually high level of unemployment that is not expected to show signs of normalization for years. In fact, several studies have shown that to reach pre-recession levels would require an additional 17 years at the estimated rate of job growth.

One of the beneficiaries of the labor force contraction has been corporate America. It is not by luck or coincidence that we are where we are today. It is by design. Before you start to think about a conspiracy theory, it is just a matter of net earnings that is driving the “you’re fired” train.

As companies have been laying off workers, they have a great deal of room to squeeze the remaining employees for additional productivity. Add to this the advancements in technology, inventory controls along with supply chain management and the result is the better profit margins and better EPS – even on limited revenue growth.

But what happens when there are no more bodies to fire? What happens when revenue stay flat?

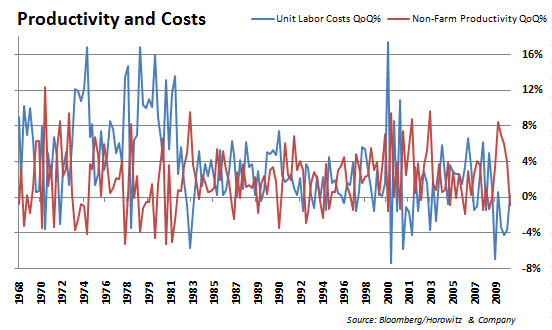

The chart above starts to tell the story. Productivity starts to collapse as there is just so much ability to push workers any further. While that occurs, the incentive to bring up levels of productivity is higher wages. Those are also showing up in the recent reports.

At risk are the margins and ultimately the profits of companies. This is what we projected to occur in the 2H of 2010 (towards the end) but appears to be showing up a touch early.

How we read this is simple: Future corporate profits will be at risk, EPS expectations will drop and market valuations will need to adjust.

Some additional insight from Briefing.com:

Economic Data Reviews: Nonfarm Productivity Declines For the First Time Since 2008

Nonfarm productivity declined for the first time since Q4 2008 as output per hour fell 0.9% in Q2 2010. The Briefing.com consensus called for productivity to increase a minor 0.1%.Economic reactions to declines in productivity are not pleasant. The data suggest that firms are oversupplied with labor for the amount of output they are creating. At the very least, employment will hold at its current level without any motivation from firms to hire more workers.

Consumption forecasts for Q3 will probably be revised lower as a result of this decline in productivity.

Productivity in Q1 2010 was revised higher from 2.8% to 3.9%.

When taken together, the upward revision to Q1 and the lower expected productivity level in Q2 would seem to offset the consensus forecast, but that may not be the best way to look at the numbers.

The consensus had already known that the output portion from Q1 was going to be revised higher due to the recent revisions to the GDP data. Economists would have also kept the number of labor hours steady, as proved to be correct by the BLS, because there was no data suggesting a change in the labor component.

Therefore, the consensus forecast of 0.1% growth would have already been based upon the upwardly revised Q1 productivity level, so it can be said the net decline in productivity was completely unexpected.

Unit labor costs increased 0.2%. That is first increase in labor costs since Q2 2009. The consensus expected labor costs to increase 1.4%.

The lack of labor cost growth will help firms remain profitable during a time of weakening productivity, but it will also depress income growth and pressure future consumption.

___

Looking to invest in The Disciplined Investor Managed Growth Strategy?

Click below for the 14-minute virtual tour….