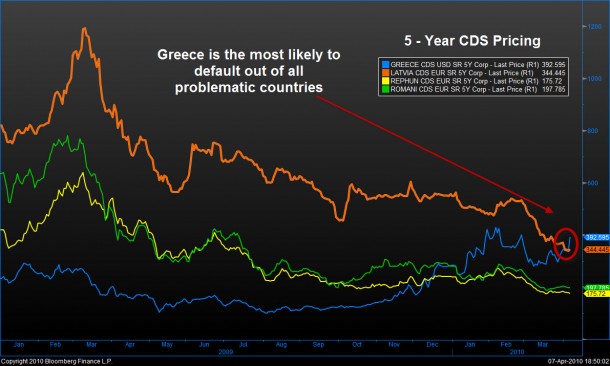

How likely indeed. Well, if you look at it in comparative terms, it is now more likely than an other EASTERN EUROPEAN country as can be seen by the cost of the 5-year CDS (default insurance).

We have been talking about the rhetoric that has been spewing from the government and officials of Greece for weeks. In fact, in the lasted TDI Podcast, we had a very enlightening conversation with Rob Parenteau on this very subject.

We know that Grece has no shot of cleaning up this mess without the full support of wither the European Union or the IMF. The idea is to keep investors happy, long enough to sell the bonds needed to provide the funds to pay for the maturing debt. Nice trick.

Uh, I have a question…. Now that Greece needs to borrow more at a much higher price than they did before… How does this help their situation? They are effectively going to swap older, cheaper debt for new higher cost debt. Seems like bad math…

Up until now, most have simply turned away and hoped that there would be a solution…any solution. Now the fear is starting to spread and is palpable. The chart above shows very clearly that the Greek government is not going to be trusted to fix their problem alone….