Considering the idea that there is a push by the Trump administration for tax reform along with tax reduction, we looked to a screen in order to find companies that may benefit. This was a topic of discussion on The Disciplined Investor Podcast (#494) and we promised to make that list available.

The effective tax rate is the average rate at which a corporation is taxed. For our use, this is the average rate at which its pre-tax profits are taxed.

One of the ways that we like to find stocks is to start with a screen – or the Quantitative approach. This starting point is the approach used in the TDI Managed Growth Strategy.

(If you would like a virtual tour of the TDI Managed Growth Strategy – CLICK HERE)

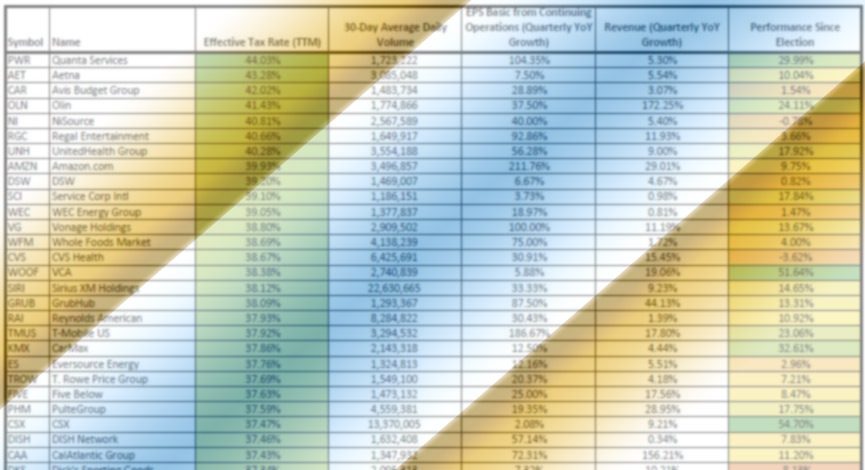

Here are the details of the screen:

- 30% – 50% Effective Tax Rate

- 30-Day Average Volume > 1 Million

- EPS Growth YoY >0.00%

- Revenue Growth YoY > 0.00%

- Market Cap > $1 Billion

The idea is to find companies with high rates, growing earnings and revenues that may see a very healthy bump to earnings and margins if their tax rate is reduced.

The results:

[gview file=”https://thedisciplinedinvestor.com/blog/wp-content/uploads/2017/01/Effective-Tax-Rate-Screen.pdf”]