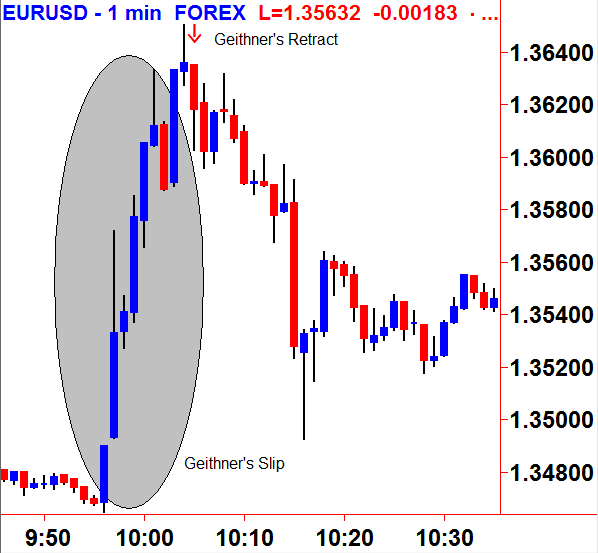

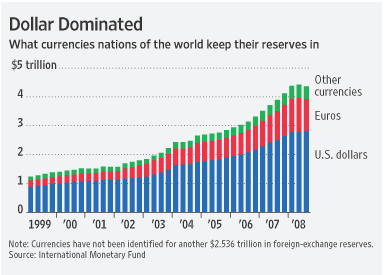

Truth be told, there still hasn’t been any sign of a recovery other than speculation on the effectiveness of government intervention. Timothy Geithner once again fumbled in a speech today to the council for Foreign Relations suggesting he was open to a global currency proposed by China causing a sharp drop in the US Dollar. Recently, China has suggested that a global currency be created to hold nations reserves rather than utilizing buying US Dollars. In the chart below US Dollars far outweigh any other currency utilized to hold reserves for foreign nations.

Courtesy of Wall Street Journal

When Timothy Geithner suggested he was open to a global currency, FX (Currency) Traders took the stance that there would be a possibility that the dollar would no longer would be used for a majority of the reserves causing a sharp dollar weakness. As the currency tumbled a former Treasury Secretary from the Clinton administration gave Geithner the chance to correct his statement. Geithner then stated “I think the dollar remains the world’s dominant reserve currency.”