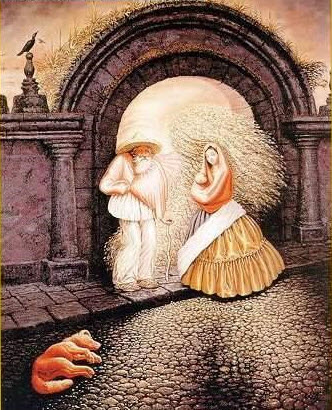

It appears that the great investment bankers of the “U.S TRAP Fund, LLC” may have found their first capital loss. Perhaps they too are looking to tax-harvesting as a viable investment techniques. Or they are just really trying to perfect the financial optical illusion.

It appears that the great investment bankers of the “U.S TRAP Fund, LLC” may have found their first capital loss. Perhaps they too are looking to tax-harvesting as a viable investment techniques. Or they are just really trying to perfect the financial optical illusion.

Isn’t it is too bad that we cannot fire them… (From the CBO’s Director’s Blog – not going to win any blog design awards)

Through December 31, 2008, the Treasury disbursed $247 billion to acquire assets under that program. CBO valued those assets using discounted present-value calculations similar to those generally applied to federal loans and loan guarantees, but adjusting for market risk as specified in the legislation that established the TARP. On that basis, CBO estimates that the net cost of the TARP‘s transactions (broadly speaking, the difference between what the Treasury paid for the investments or lent to the firms and the market value of those transactions) amounts to $64 billion””that is, measured in 2008 dollars, we expect the government to recover about three quarters of its initial investment.

Okay, so we are making assumption that 75% of the money they have spent will come back. So far, that is not what I would call protecting the taxpayer. Nor is that what I thought that was said by many to be a PROFIT on the transaction, but let us move on….

The Office of Management and Budget‘s (OMB‘s) report on the TARP, issued in early December, only addressed the first $115 billion distributed under the program. CBO and OMB do not differ significantly in their assessments of the net cost of those transactions (between $21 billion and $26 billion), but they vary in their judgments as to how the transactions should be reported in the federal budget.

When they say “net cost”, are we to understand that this is to be embedded as an assumed cost of doing business. It appears that they are now looking at this as an acceptable fee to help bail out the folks what got us here in the first place. But, again, what happened to the profit idea. You know the one we were told was part of the reason the Congress approved this monstrosity.

Thus far, the Administration is accounting for capital purchases made under the TARP on a cash basis rather than on such a present-value basis””that is, the Administration is recording the full amount of the cash outlays up front and will record future recoveries in the year in which they occur. That treatment will show more outlays for the TARP this year and then show receipts in future years.

HOLD THE PHONE! isn’t that called : Creative accounting? Is Mark-to-market has been thrown out here by the administration? Are they kidding? Look closely a the wording here.

..The Administration is recording the full amount of the cash outlays up front and will record future recoveries in the year in which they occur..

Therefore, there will be a loss booked for the years in which they money is spent and then will come back as a wonderful gain in the future. This way, it will look as if the TARP shows a profit in future years. Once again effectively bamboozling the public by creative accounting. Right?

This is a game that I am very concerned about. If companies totally write down the value of an asset now, then show income against the lower value, it appears that they have an amazing profit. In addition, if they sell off that asset in the future, it will also look as though the profit is enormous. It will be very hard to track back the asset in 2,3 or 5 years and the company (TARP) will show an amazing profit.

Only it will be a false profit that was created by a sneaky accountant.