Natural gas prices have been falling for some time. Some believe that there is an abundance beyond measure that will keep prices constrained for a very long time.

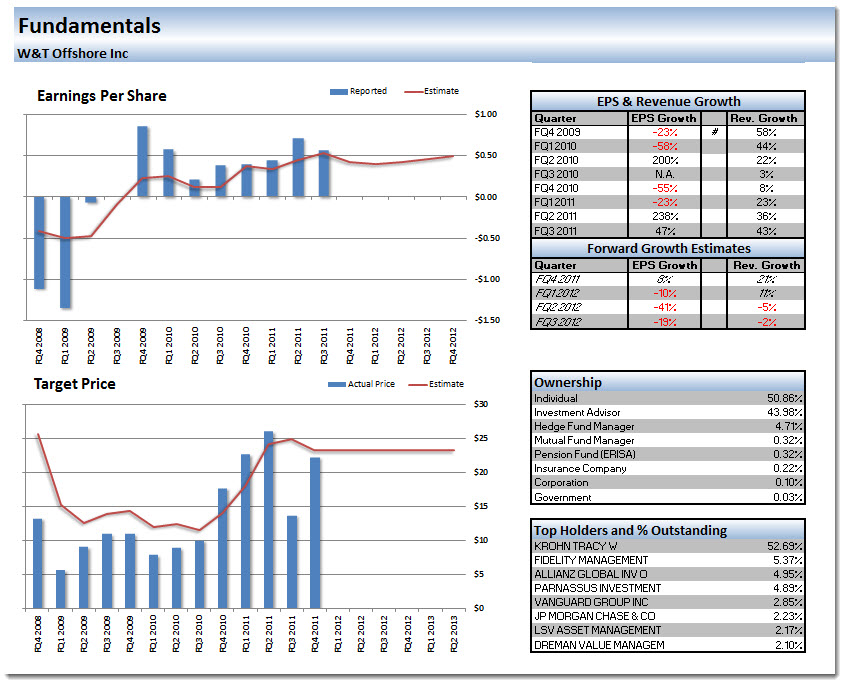

Other feels that this is the time for a different fuel that will provide for energy independence etc. Whatever your opinion, the fact is that W&T Offshore (WTI) seems to be in a position to benefit. The company has had a hit or miss record with earnings over the past few years, but in total they appear solid. Of course that is all dependent on the state of the economy and how cold/warm the weather is going to be.

Horowitz & Company’s proprietary Technical Scoring System (T|score) takes into consideration both individual security technicals as well as the overall market direction when considering whether or not to purchase a company. H&C’s Market Trend Indicator (MTI) is a measure which is designed to evaluate the overall trend in the market. There are four designated levels to assess the trend which include: Strong Downtrend, Downtrend, Rally and Strong Rally. We are currently in an environment where the MTI is in a Rally. All of our indicators are showing that the markets are currently in a stable rally or have pulled back from a Strong Rally. Those with a moderate risk tolerance could begin to look for securities breaking out on their radar with medium to higher technical scores. With that said, this stock ranks in the highest percentile of stocks from an individual security technical score. H&C would consider purchasing a small portion of this position even during a Strong Downtrend. This position would be a definite purchase if the market were to be in Downtrend or any kind of Rally.

Below are some of the areas where W&T Offshore Inc (WTI) excelled or detracted from the value of the technical score:

Stochastics are currently showing some bearish attributes which may mean this stock is slightly overbought in the short run.

In terms of price and volume especially over a short period of time it is important to see if there is any weight behind either a rally or correction. This company has shown to have less than favorable price action in terms of volume and therefore has a greater chance to move lower if the overall market and economy are to trend lower. Higher volume with negative price also will provide resistance levels for this position if it were to increase back to these levels.

On a 12-month rolling period this company has performed very well when comparing against its peers and equities in the S&P 1500. We see this as a positive sign for this company as it shows strength relative to the overall market

H&C currently sees W&T Offshore Inc (WTI) in a Short Term Uptrend and Long Term Uptrend.

___

Looking to invest in The Disciplined Investor Managed Growth Strategy? Click HERE for the virtual tour….

___