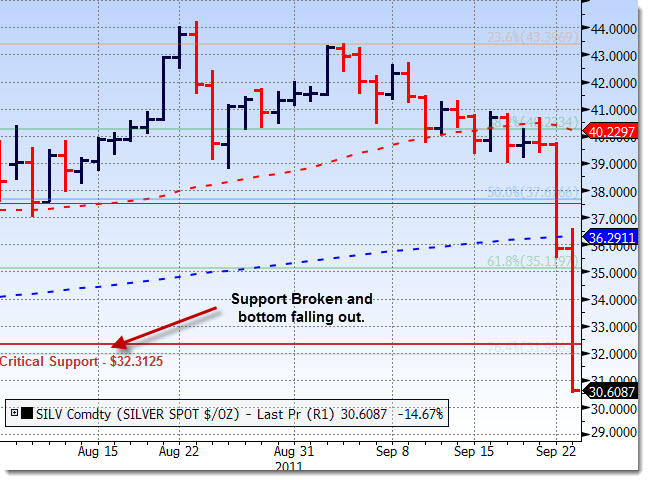

Gold and Silver are declining sharply in the face of global economic uncertainty, low interest rates and confusion over inflation. 2011 maybe a long way from 2008, but after the recent and dramatic run up, the price action is eerily similar are acting similar to 2008. In the last recession we saw almost every asset class become fully correlated. Bonds, stocks, REITs, commodities and even hedge funds dropped as liquidity and cash became king. Gold and silver are now acting in a similar fashion to what was seen when there was a mad rush to liquidate whatever asset was available.

(Look HERE for the last few discussions we had on SHORTING SILVER)

In a “typical” economic slow down, investor’s generally show a flight to tangible goods as they want to own things that as Dennis Gartman would say “Hurt when they are dropped on his foot”. Gold and Silver typically have been a good hedge against economic slowdowns with the exception of 2008 and the recent down turn. Despite interest rates on cash and U.S. Treasuries, investors are leaning toward safety and liquidity despite these traditional hedges.

Inflation has been a concern as the dollar continues to weaken and the Fed keeps rates artificially low. Operation Twist could possible stunt some of the inflationary pressures however as the Fed sells shorter term treasuries and purchases longer term treasuries. This may give consumers some incentive to deposit cash into money market accounts and short term CDs but these instruments still are not paying much. Not sure if anyone has seen any good money market rates, but I can tell you that last time we checked most brokerage money market accounts are paying less than 15 basis points.

If this flight to liquidity rather than safety occurs, a domino effect could occur in the markets. We do believe however that hedge funds, banks and other institutions are less leveraged now which should exacerbate some of the move to more liquid assets. Investors are still skittish and 2008 is still fresh in their minds, especially those baby boomers looking to retire.

The bottom line on this sell off is that is is a combination of a liquidity run followed by a margin maintenance imposed sell requirement. $30 no looks like support, but this is a wild one….

Keep an eye on this trend as time rolls on, in effect it it is not a good sign…

NOTE: We had previously BOUGHT the November 2011 PUT and sold it for a profit of approximately 125%. But, one more day and that would have blossomed to a 475% 500% profit as Silver is crashing.

___

Looking to invest in The Disciplined Investor Managed Growth Strategy? Click HERE for the virtual tour….

___