During the month of September, we are going to be adding a special section to this site.

The TDI Managed Growth Strategy provides a private “client-only” blog where we discuss the day and our general outlook. Areas that we cover range from current holdings analysis, economic reports, political commentary and more.

The primary purpose of the “client-only” blog is provide information so that clients for whom we manage money will have a better understanding of what is the rationale for portfolio decisions. In addition, the information is designed to be educational so that readers can learn from both our mistakes and successes.

On a daily basis, simply follow www.thedisciplinedinvestor.com or use an RSS reader and point it to : http://tinyurl.com/3u3jahy or http://www.thedisciplinedinvestor.com/blog/category/stocks/insideedition/feed/

2011-09-19

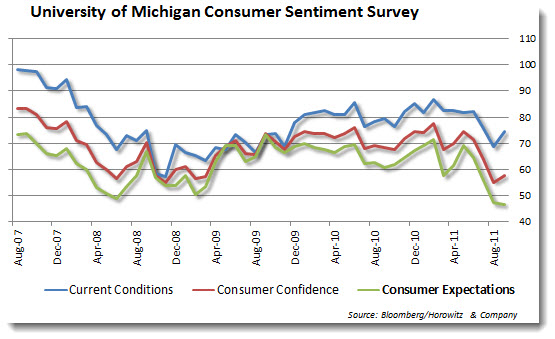

Last week we saw some new information revealed about the economy. Generally it was seen as better than expected, but all of the data-points are still flashing a warning. The most concerning is the low level of the UMich Consumer Sentiment Poll that came in slightly higher than expectations for September, but was still at depressed levels. Dissecting the report gave us additional details as to the expectations component which fell 0.4 points to 47. This is the lowest level since back in 1980 and does not bode well for the outlook of the American consumer.

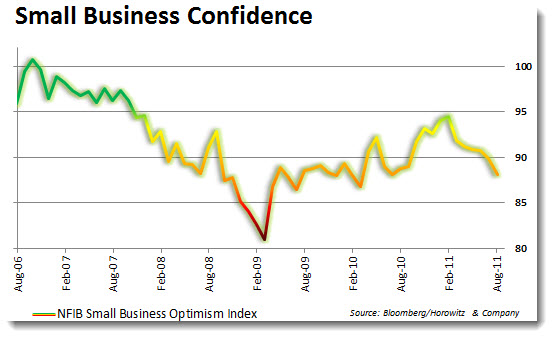

There is also a good amount of gloom in the small business sector. Most economists believe that this is the heart of the U.S. economy. The small businesses are the entrepreneurs and the success stories in the future and as they grow, they will be the largest contributor to new hires. Confidence is moribund at this point and looking as if the slope down will continue.

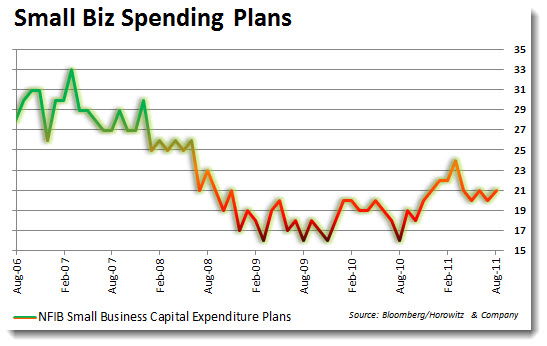

The lack of a positive outlook does not provide any incentive for businesses to spend. This makes total sense as the natural protective measures for management will be to cut back and wait until there is a clearing before making any big financial decisions. The reaction is no different than a turtle puling its head back into its shell if it has any fear of being harmed.

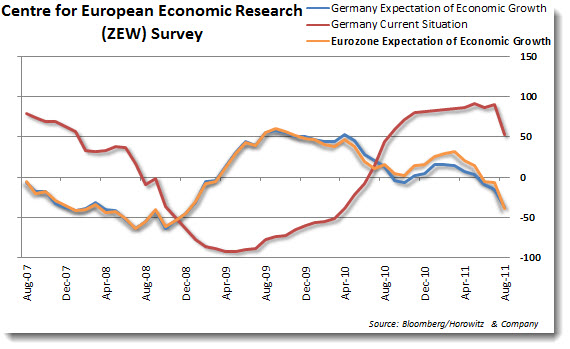

Over the past few months, the turtle has peeked out to survey the situation and test the danger levels. What it found it did not like and quickly pulled back for safety measures. The above chart is that danger reflex in motion. Since 2008, each time there appeared to be an all-clear signal it was not sustainable. Without question the uncertainty surrounding regulatory and legislative change has something to do with that. How in the world can a business plan for their future if the rules of the game keep changing?

European confidence is no better either. With the banks in a financial upheaval and no end in sight, the confidence readings are falling at a staggering pace.

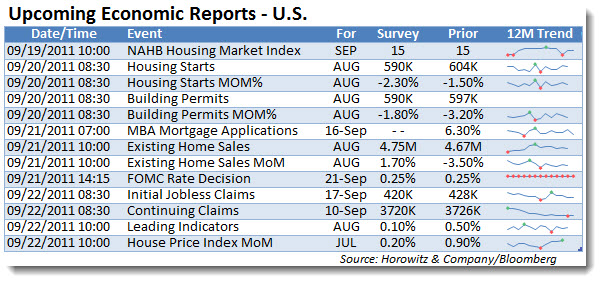

It is a relatively light week for economic reports. The key driver this week will be the FOMC rate decision on Wednesday. While there will be no change in the Fed Funds rate, there is a good deal of anticipation that there will be some announcement as to further measures to boost stocks the economy.

The FED Board of Governor’s meeting this month has been expanded to two days. The announcement of the additional day has led to speculation that this will be another contentious meeting with considerable dissension over any further easing policies. The bull argument is that some form of additional QE is going to be pushed by Mr. Bernanke and he will need all the time available to make his argument and persuade those against the idea to acquiesce.

The general consensus is that the FED will start to use the maturing debt, acquired during the past two QE initiatives, to add to longer maturity treasuries. In theory, this is designed to lower interest rates on home mortgages and consumer loans, providing additional stimulus. However, there are some flaws in this logic.

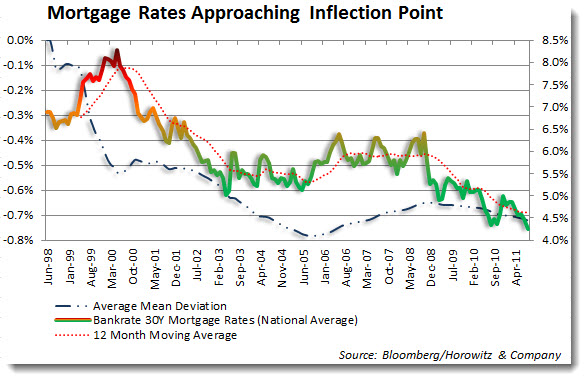

Mortgage rates are the lowest since recording began in 1998. When viewing the trend, the 12-month moving average has been coming down along with rates, there is some significance to the move above or below the average as it is an indicator of the near-term direction. But, since there is more than simply supply and demand that is responsible for a change in these rates, not much can be projected when a break occurs.

Adding to the chart a series that calculates the deviation of the mean (AMD) over time shows that when this moves to an extreme (lagged) there is often a turn toward a reversion to the average. This may take months to complete, but the current AMD is at a level that is close to historically low levels (meaning the deviation from the mean of the series is the greatest level below) and may indicate that mortgage rates have little ability to trend lower for much longer.

We have made the case that the idea of reducing rates is opposite of what should be done at this stage of the housing cycle. While FED Chief Bernanke is a staunch combatant of deflation, the very idea that he will continue to push down rates provides no incentive for home buyers to lock in a rate or rush to buy. The basic premise behind deflation is that consumers will only act if they believe that they will have to pay more in the future. By continually pushing rates down, the natural result is that the consumers of homes will continue to sit on the sidelines until they are pushed to act as rates begin to rise.

The only reason at this point to continue the drive to lower rates is to boost the value of the assets on the balance sheet of the FED ($2 trillion+++) and/or lower the debt service costs on the $15 trillion of debt the U.S. has issued. Other than that, the conversation the FED is having with the public is nonsensical.

![]() In this week’s TDI Podcast, there is a great discussion with Barron’s Mike Santoli – Listen in

In this week’s TDI Podcast, there is a great discussion with Barron’s Mike Santoli – Listen in

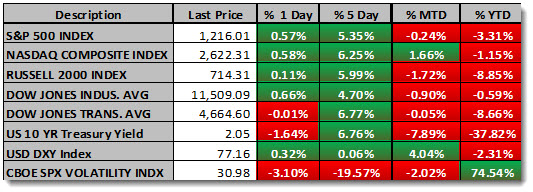

Let’s take a look at the recent scorecard to see how things are shaping up around the world for equities, fixed income and currencies.

The big move last week took the major U.S. large-cap indices toward the unchanged area for the money, but there is still some work to do for the year. Small-caps outperformed last week, but have been beaten up over the quarter.

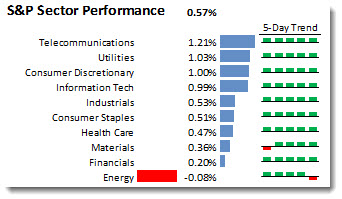

Friday’s sector summary:

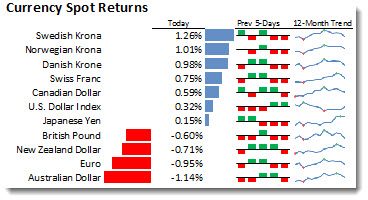

Finally, currencies. Notice the move for the U.S. dollar over the past few weeks.

Overnight, futures reacted negatively to the lack of any support for the European banks during the weekend minister’s meetings. Asian markets are all in the red (Japan is closed) and the Euro gapped lower off of the open by almost 1%.

The short position in the 2X European Short ETF (EPV) should provide some cover and the size of the position will be re-evaluated today. We are looking into a few alternatives to provide a bigger exposure on the short-side to Europe now that things are coming to a head. Stay tuned…

___

Latest Podcast Episode: TDI Podcast: Shorting Europe, The Mystery Broker, Market Rally Almost Done (#230)

Guest(s): Mike Santoli, Barron’s

___