During the month of September, we are going to be adding a special section to this site.

The TDI Managed Growth Strategy provides a private “client-only” blog where we discuss the day and our general outlook. Areas that we cover range from current holdings analysis, economic reports, political commentary and more.

The primary purpose of the “client-only” blog is provide information so that clients for whom we manage money will have a better understanding of what is the rationale for portfolio decisions. In addition, the information is designed to be educational so that readers can learn from both our mistakes and successes.

On a daily basis, simply follow www.thedisciplinedinvestor.com or use an RSS reader and point it to : http://tinyurl.com/3u3jahy or http://www.thedisciplinedinvestor.com/blog/category/stocks/insideedition/feed/

___

2011-09-16

During the meetings/panels at the Bloomberg 50 Conference, there was a good amount of information regarding the EuroZone that was being discussed. Yes, there is the new plan to flush the banks with dollars as there is obviously a major liquidity problem. Already we are seeing the same type of slow “Lehman Style” meltdown as institutions are shutting off any lending to European banks. From the commentary, most participants at the conference have also lost confidence in the situation.

Some economic reports:

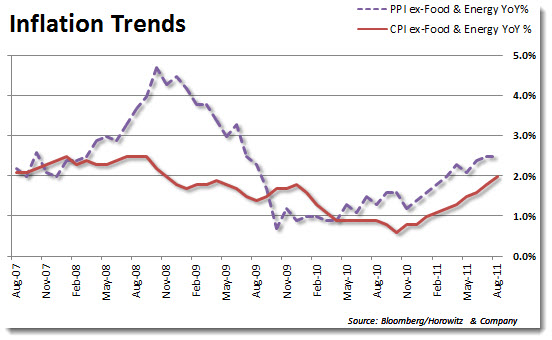

Aug. CPI rose 0.4% M/m vs est. 0.2% (range 0.2% drop to 0.4% gain). Ex. food, energy, CPI rose 0.2%, matching est. 0.2% (range 0.1% decline to 0.3% rise).

CPI “influenced by inclement weather across the country,” with food spiking amid drought, record 100-degree days in Texas, says Bloomberg economist Rich Yamarone.

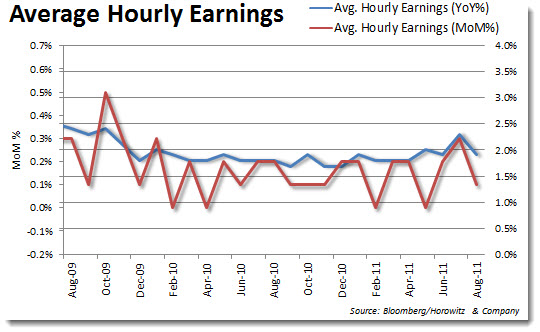

Real average hourly earnings fell 0.1% in Aug. as “consumer still struggling with dwindling incomes,” says Yamarone of Bloomberg.

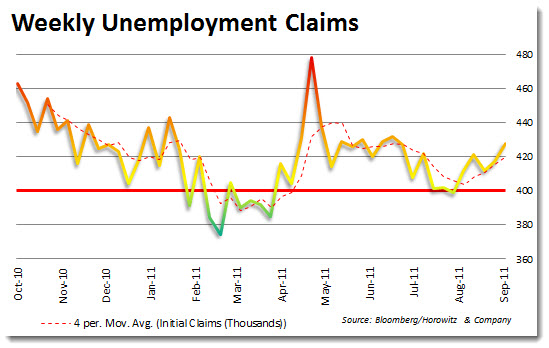

Initial jobless claims week ended Sept. 10 rose to 428k, the highest since June, vs estimates of 411k (range 400k-440k); the prior week revised to 417k from 414k (current 4-week moving avg. 419.5). The spike in claims spike likely on Hurricane Irene, says Bloomberg economist Joseph Brusuelas.

There was a great deal of optimism that the European debt fiasco would see a quick resolution now that Tim “The Knee-Capper” Geithner was heading over to a meeting of the EuroZone financial ministries in Poland. Tidbits about what he would proposed were flowing through the newswires throughout the week and as usual ran the gamut of many different possibilities. At first, there was news that he would not advise on increasing the ESFS bailout fund. Then there was news that in fact he was going to suggest that a major increase be made along with the help of private institutions.

We found it rather odd that there was going to be a major role for Mr. Geithner in this forum at all. This is a European problem and what is it the business of the U.S. to step in? Interestingly, the actual outcome was far more critical of the U.S. and the role that it played in bringing down the global financial system. In short, Europe is telling the U.S. that they may listen, but please do not try to provide advice.

From the New York Times:

Financial officials from the United States, once called “the committee to save the world” after the Asian crisis in the 1990s, now find themselves uttering apologies for the harm caused to the world by the 2008 financial crisis and coating their advice to European nations with the knowing nod of the battle-hardened.

The change in tone was on display here on Friday when Treasury Secretary Timothy F. Geithner made an unusual appearance at a meeting of euro zone finance ministries. Mr. Geithner had been invited to offer some advice on fixing Europe‘s sovereign debt and banking problems.

European leaders, who have been slow to react to the root causes of the problem, emerged from the meeting dismissive of Mr. Geithner‘s ideas and, in some cases, even of the idea that the United States was in a position to give out such pointers.

“I found it peculiar that, even though the Americans have significantly worse fundamental data than the euro zone, that they tell us what we should do,” Maria Fekter, the finance minister of Austria, said after the meeting Friday morning. “I had expected that, when he tells us how he sees the world, that he would listen to what we have to say.”

Such criticism was echoed by other attendees of the meeting, including the finance minister of Belgium, Didier Reynders, who said Mr. Geithner should listen rather than talk. Jean-Claude Juncker, president of the finance minister group, said European officials did not care to have detailed discussions about expanding their bailout fund “with a nonmember of the euro area.”

With the end of the week showing that markets are in a much better mood, two of our three uptrend indicators are now flashing green. There is still some work to be done to get the “all clear” signal, but there has been a decent amount of upward trajectory that shows support building recently. At the same time, many stocks are starting to show a nice consolidation and those stocks with the highest fundamental scores have been acting well. The one caveat is that these same stocks should have done much better considering a 5% week for the S&P 500.

The best sectors and stocks over the past 5 days have been those that have the least attractive fundamentals. Banks and financials got a big boost and were a large part of the movement for the indices.

That was not too helpful for TDIMG portfolios as they were only able to squeeze out a small gain, close to 0.50% for the week. Some of the detractors were the position short of Silver, short Europe and a couple of stocks that were cut at their trailing stop-loss points.

Today, we rotated into some of the higher technical scoring stocks that have top fundamentals and sold the following:

- CF industries (4% loss)

- Spreadtrum Communications (3.1% gain)

- Ulta Salons (2.5% gain)

- Hansen Natural (10.2% gain)

- Fastenal (1.9% gain)

- New Oriental Education (5.3% loss)

Before the markets get too far ahead of themselves, there are still some problems right here in the U.S. that need to be dealt with. The main issue being the worsening employment condition. In California, state employers reduce payrolls in August for the second month in a row as they see signs of a faltering economy, pushing the jobless rate up to 12.1%. With the VIX still above 30, there is a good deal of concern traders have and volatility will remain. The market mood will continue to react on the news out of Europe next week and over the next few months. That will keep us in the short European position until there is a better understanding of how the unsolvable problem will be solved.

From our vantage point, it is looking more and more likely that there will be a default of Greece within the next few months. Just today, Greece has announced that they will need the next tranche of funds fro the ECB/IMF sooner than anticipated. While there has been comments that the IMF is prepared to release the next bailout check, it is difficult to believe that they will be so forgiving of Greece’s inability to keep their end of the agreement on debt/deficit reduction.

Here is the dirty little secret that no one wants to let out: Greece is holding all of the cards. They know that exiting the EuroZone would be a catastrophe and fully understand that the “rich” European countries will do whatever it takes to hold this together. With this knowledge Greece has been able to break promise after promise with the attitude that they will get the money they requested. Unfortunately for Germany and France, there is little that can do as their banks and financial institutions hold an enormous amount of Greek bonds.

Already the backstops and safety nets have been drawn so that if a default occurs, there will be liquidity available for the European banks.

Our general plan for the portfolio is to have a short position against European equities. This will provide short exposure to both to equities and the Euro. In addition, we are holding approximately 40% long equities with another 20% ETFs, diversified in Peru, the Russell 2000 index and the S&P 500 Utilities sector. There may be concentrated exposure added against the European stocks, depending on the results of the German election and an update on Greece and Italy. More on that next week.

The bottom line: While we may not like the backdrop, there is no use fighting the tape which now shows a short-term uptrend within a larger down-trend. We expect a retest of the lows if Europe fears continue and economic reports deteriorate.

___

Latest Podcast Episode:

TDI Podcast: Should I Sell, Buy, Cry? $450,000 PER JOB? How To Hedge (#229)

___

Looking to invest in The Disciplined Investor Managed Growth Strategy? Click below for the virtual tour….