During the month of September, we are going to be adding a special section to this site.

The TDI Managed Growth Strategy provides a private “client-only” blog where we discuss the day and our general outlook. Areas that we cover range from current holdings analysis, economic reports, political commentary and more.

The primary purpose of the “client-only” blog is provide information so that clients for whom we manage money will have a better understanding of what is the rationale for portfolio decisions. In addition, the information is designed to be educational so that readers can learn from both our mistakes and successes.

On a daily basis, simply follow www.thedisciplinedinvestor.com or use an RSS reader and point it to : http://tinyurl.com/3u3jahy or http://www.thedisciplinedinvestor.com/blog/category/stocks/insideedition/feed/

The is no argument that this has been an insanely on-again, off-again market. With no sign of relief from catastrophes, man made or otherwise, each day brings a new challenge that investors need to consider. The result has been this awful whipping action that is causing all sorts of mental pain for anyone involved in the financial markets.

The is no argument that this has been an insanely on-again, off-again market. With no sign of relief from catastrophes, man made or otherwise, each day brings a new challenge that investors need to consider. The result has been this awful whipping action that is causing all sorts of mental pain for anyone involved in the financial markets.

Even though we have a few long positions in the portfolio, the week ended with a positive return for TDIMG portfolios. Friday’s mega-mess within Europe provided a nice boost to the short European shares, which we are using a 2X Inverse ETF (EPV) as the investment vehicle.

Over the past few days we have been adding to the short position as the saga continues to worsen. Into Friday, the size of the position is close to 28% of the portfolio (synthetically leveraged) and we will be looking for signs that provide evidence that there will be a turning point where we will consider taking profits. By day’s end we intend on bringing the position back to no more than a 25% level and we are using this as a short position of European stocks hedged against our long equity positions.

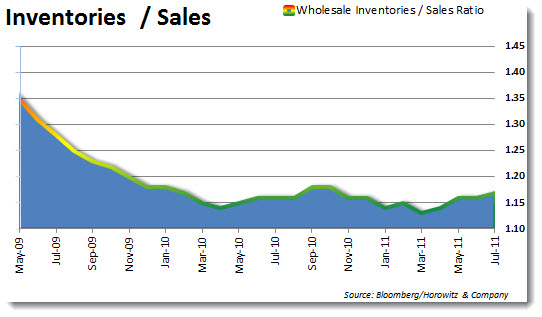

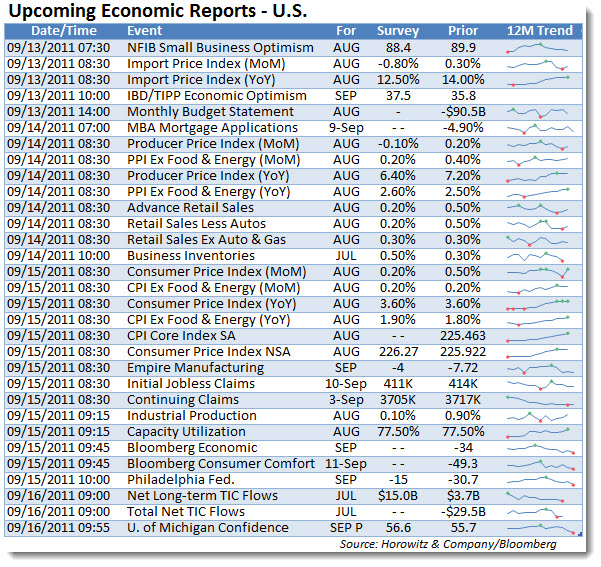

In U.S. economic news, Wholesale Inventories rose for the period. As we have explored before, this is one of those reports that can be looked at in two different ways. While the rise in inventories shows that manufacturing may have increased, it also may have been the result of lower sales. The best way to view this is through the Inventory/Sales ratio to make a reasonable assessment of the situation.

The level of 1.17 is slightly higher than last month and the trend is also moving up, but the slope is not indicative of a situation like we saw in 2008 when sales collapsed. Still, the information above does not provide a behind the scenes look at who is actually purchasing or what is being manufactured.

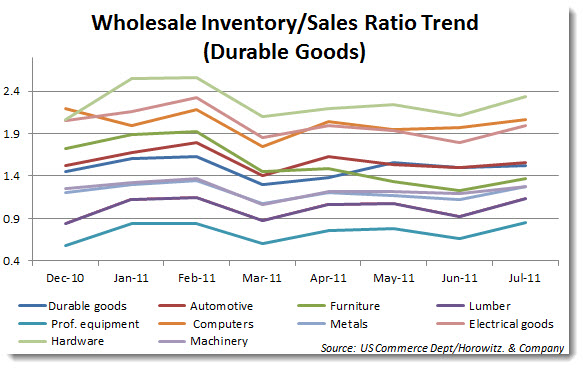

Breaking it down by individual components, first let’s take a look at the Durable Wholesale Inventories:

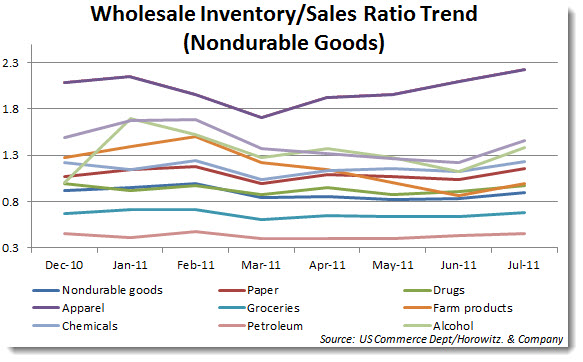

The biggest and most consistent rise can be seen in Apparel. Furniture has also been moving higher as consumers have been cutting back on discretionary items. Again, nothing here is showing that consumption has slowed enough to be problematic at this point. However, there are indications that with confidence waning, employment high and markets around the world plunging that this could be the beginning of something much more than a simple soft patch.

For their part, Central Bankers around the world have been doing what they can to instill confidence in markets. The trouble is that they rarely say anything other than positive expectations about the future. This is their job and when they say otherwise, investors often take cover. Last week was one of those times that there was a different tone presented by both both the European and U.S. leaders.

For their part, Central Bankers around the world have been doing what they can to instill confidence in markets. The trouble is that they rarely say anything other than positive expectations about the future. This is their job and when they say otherwise, investors often take cover. Last week was one of those times that there was a different tone presented by both both the European and U.S. leaders.

First there was the speeches by FED Chief Bernanke who continues to downgrade his assessment of the U.S. economy. On top of that, the ECB President, Jean-Claude Trichet has a rather downbeat commentary on his outlook for the region. Confidence was low already and Friday’s sudden resignation of Jürgen Stark, Vice-President and part of the executive board of the ECB didn’t help.

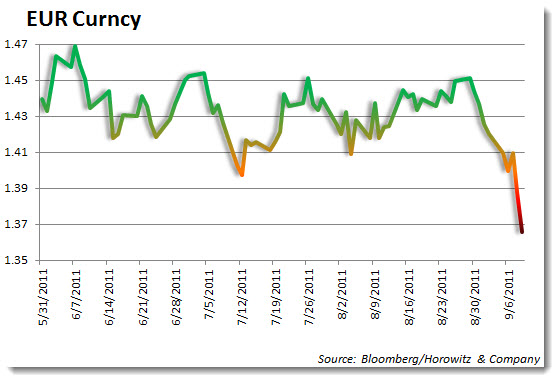

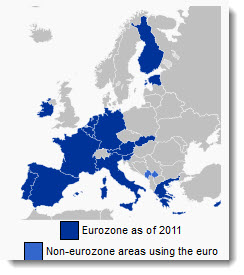

As an outspoken conservative, Mr. Stark was highly critical of government’s role in the bailout of Greece and other nations. Germany’s link between the Bundesbank and ECB may now have some real problems as there is rising discontent over Germany’s role in providing an unlimited backstop for the Euro nations. This revelation sent the Euro currency plunging to a six-month low on Friday.

The problem is not contained to the Greek or even the Italian markets. European markets have been roiled and banks are getting slammed. Unfortunately, it is starting to look like it may be every-man-for-themselves as Germany is preparing to pull back from their promise. Caught in the crossfire are the banks. As they have had no other choice but to believe that the ECB/IMF would be there to relieve any financial pain inflicted from the Euro experiment, they have been holding the toxic debt of the countries within the region.

___

Looking to invest in The Disciplined Investor Managed Growth Strategy?

Click HERE for the virtual tour….

___

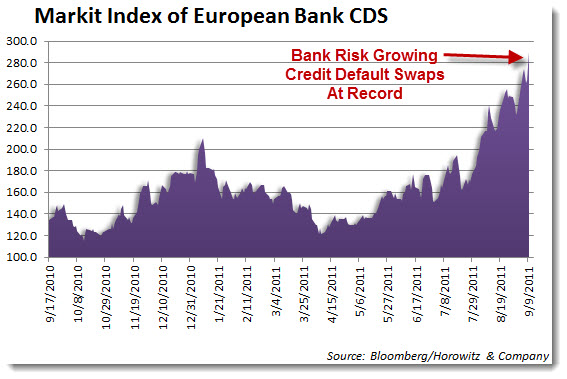

Since selling their stakes would deepen the crisis, many are saddled with the bad debt with no one to sell it to. Investors have caught on to this and even with short-selling bans in may of the countries, the unloading of European bank shares has been dramatic. The risk concern is most pronounced when looking at the recent trend of Credit Default Swaps on European banks.

France”s financial disarray has been something that we have been very concerned about over the past few months. For whatever reason, the problems within France have been an afterthought in most commentaries and analysis pertaining to Europe’s problems. As we see it, this is perhaps the most worrisome of all that is going on as France, Italy and Germany have been the three major parties that have been funding/backing the European Financial Stability Facility (EFSF).

% Funding of the EFSF: (the current maximum level of joint and several guarantees)

Germany 27%

France 20%

Italy 18%

Beyond to the original ‚¬780 billion that was pledged, an additional ‚¬440 billion of guarantees would fall on the countries with AAA ratings and in truth, their taxpayers. Already there is a question as to whether France will be able to maintain its rating in the face of the liquidity difficulties their banking system is presenting. News that Moody’s may be downgrading several French banks in the near future is not going to help.

From Bloomberg:

Societe Generale SA , BNP Paribas SA and Credit Agricole SA are being quoted higher rates than their competitors in the commercial paper market as the crisis in the euro zone spreads beyond Greece, Portugal and Italy.

Investors charged the French firms an average 6.7 basis points more to borrow three-month commercial paper on Sept. 8 than the rate the lenders said they could pay in the London interbank offered rate market, according to two buyers who asked not to be identified because the talks are private. As recently as July, the banks received CP rates that were lower than Libor.

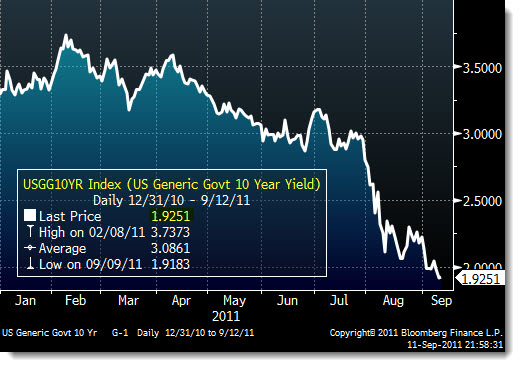

At the same time, U.S. Treasuries have been the go-to safe haven investment. Even with the recent S&P downgrade, it is quite remarkable that we continue to set record low rates on short-term treasuries. The yield on the benchmark 10-year Treasury note dropped to a record low on Friday, as worries about European debt, a weak U.S. economy and anticipation of a new round of quantitative easing boosted the appeal of Treasuries.

As Treasury prices soared, the 10-year yield slipped as low as 1.89% Friday, from 1.99% late Thursday. The silver-lining here is that the U.S. is receiving a significant benefit as the cost to service its debt are declining.

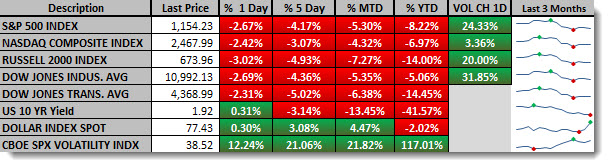

Let’s take a look at a recap of the recent market action to get a feel of just how U.S. equities and bonds are performing.

The standout is definitely the 10-year bond. With a yield lower by 41% year to date it underscores the flight to safety that is occurring. That is also confirmed by the spike in both the U.S. dollar index as well as the VIX.

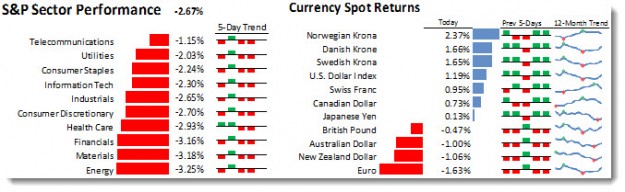

The recent view of the S&P GIC Sectors and currencies: (Click to enlarge)

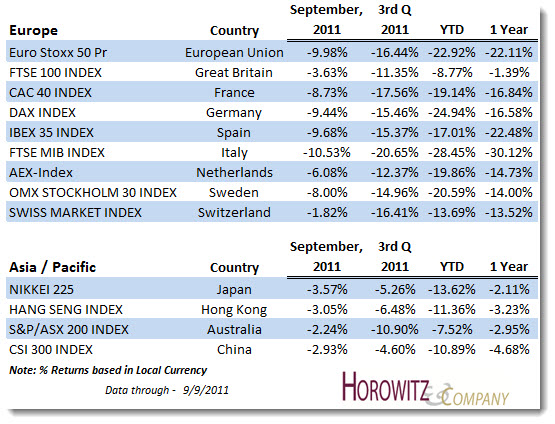

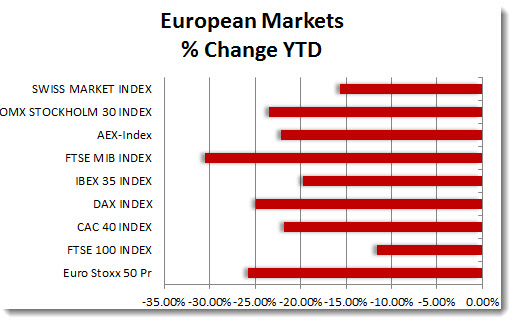

The rest of the world’s markets are in much worse shape. In particular, Europe has dropped significantly over the past few months.

A year-to-date snapshot chart of European markets:

As mentioned at the end of last week, we are coming into this week with a 22% position SHORT Europe. This is against an approximate 45% long position in individual equities. It is interesting that even in this turbulent time for global equity markets that the positions we are holding are scoring so well, both fundamentally and technically. Still, if markets are to move down to test the August lows, it may be hard to keep even these from dropping. With that in mind, preplanned sell-stop levels for each position have been calculated and we will drop any position that falls below or score moves under the threshold as we are still marking this as a market downtrend.

___

Latest Podcast Episode: TDI Podcast: Should I Sell, Buy, Cry? $450,000 PER JOB? How To Hedge (#229)

___