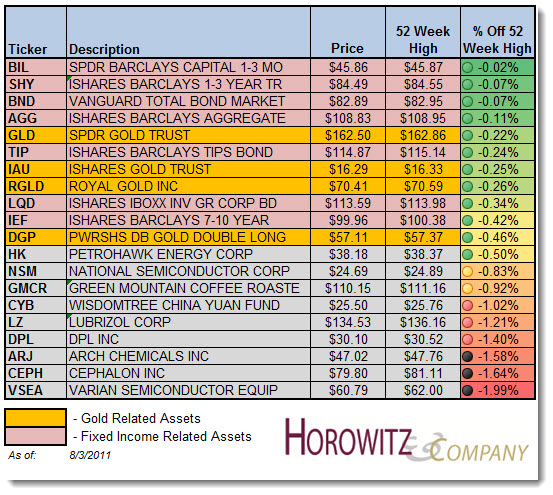

In this edition of the weekly stock screens we are going to take a look at those companies who are defying the laws of market physics. Despite the recent market sell-off these companies and exchange traded funds have been surprisingly buoyant. We defined this screen as stocks that are off of there 52 week high by less than 2.5%. The details of the screen are listed below:

- Stock Universe: All US Exchanges

- Average Daily Volume: 500,000

- Price: >$10

- Catalyst: Price is less than 2.5% off of 52-Week High

Total Results = 20

What is interesting about these companies and ETFs is that first off we notice 2 things:

- Fixed income assets remain strong as the flight to safety trade is on and the possibility of QE3 or further stimulus is back on the table.

- Gold related assets continue to outperform as we once again have flight to safety, but also the continued pressure on the US Dollar has many investors seeking out an alternative.

One other thing that is not quite as easily noticeable is that HK, NSM, LZ, DPL, ARJ, CEPH and VSEA are all companies that are being bought out.

So with that said, this pull back has not been kind on even the strongest of companies.