The vote has been tallied and we now know.NOTHING! That is right, the only thing we know is that the Greek Parliament has provided a vote of confidence for George Papandreou. Now the austerity plans have to be implemented in order to receive the final tranche of money for Greece to operate for the next month or so.

The vote resulted in rioting in the streets of Athens as thousands of protesters are angry over the severe financial cuts that will be required. Retirement plans, city workers and other social programs will be cut to the bone. Is it any wonder why the IMF and EU are unsure about the next $160 billion that has been requested?

From Brieifing.com

Floor Talk: Pullback in market coincides with FT story that Greece’s opposition leader said the party would vote against austerity measures The equity market just pulled back from the morning highs, with the Dow giving up about 20 pts since the top of the hour, despite better-than-expected housing price data. While the headlines that Greece’s opposition leader said the party would vote against austerity measures may appear negative at first glance, it’s not a big surprise at all that the Opposition Party will vote against austerity measures. Considering the divided (155-143) nature last night’s “no-confidence” vote, and the fact that no members of the opposing party voted in favor of Prime Minister Papandreou, the latest headlines that the Opposition Party will oppose austerity aren’t surprising at all.

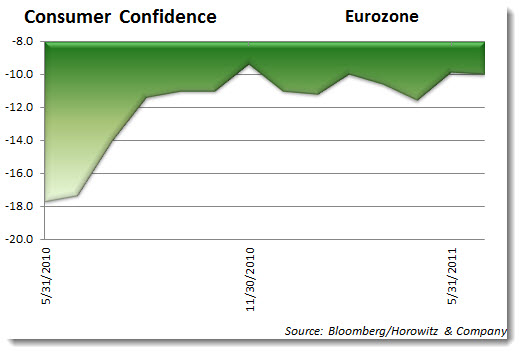

The dour mood has spread across Europe as the aftermath of the PIIGS austerity plans take hold.

Even as there has been a slight tick higher over the past few months, the general outlook is less than sanguine.

Even as there has been a slight tick higher over the past few months, the general outlook is less than sanguine.

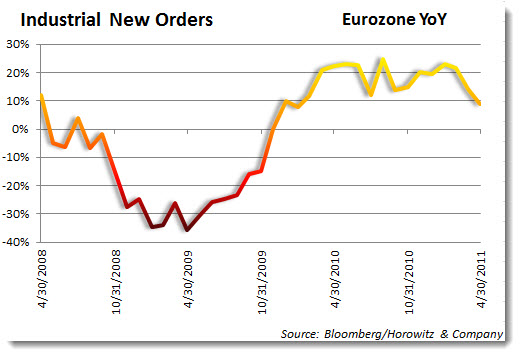

Industrial Output from the EuroZone has also been faltering. On a year-over-year basis, EuroZone’s industrial orders have been falling as there is a general slowing of the global economic backdrop. This has also been hurt by the increasingly and astoundingly strong euro.

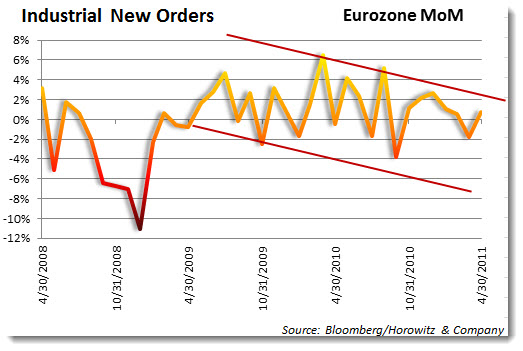

Looking at the same series with a closer timeframe shows that there is an apparent downtrend that is staying just above the unchanged mark. In other words…stalling. That makes a good deal of sense as backdrop of global economic conditions continues to slow.

And of course, today’s festivities will be capped with the rate decision by the FED. With the new and improved FED, there will be the announcement at 12:30, followed by the Fed’s 2011-2013 Economic Projections at 2:00pm and then Bernanke Speaks at Fed Press Conference at 2:15pm. It is widely believed that most of the questions have been pre-screened and rehearsed. Any slip or utterance that may be taken wrongly by market participants could be disastrous. Remember, the FED is all about “confidence” building and even they have talked about managing expectations through commentary to move market conditions and rates.

The dollar should strengthen after the FED’s comments, even if there is a lowering of their outlook. Either way, there could be a move toward the “safety” of the U.S. currency if there is no indication that additional stimulus programs will be announced and that should put some upward pressure on the USD, especially now as the EURO may start to be sold in front of the problems that continue to emerge in Greece and now what is looking to become an even bigger headache in Spain.