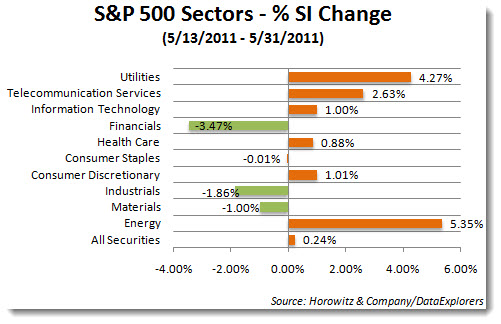

The short interest reports come out every two weeks. The positioning on 5/13/11 was curious as it was showing a great deal of overall complacency. That data showed that it was primarily the consumer discretionary sector which was seeing an noticeable uptick in bearish activity. At that time, we concluded that there was the potential for a drop in equities on any disappointing news.

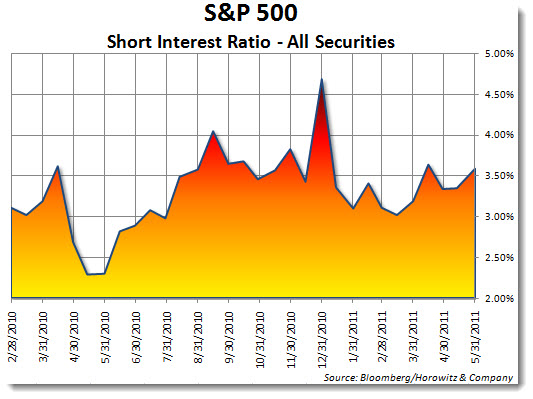

Now the short sellers have stepped it up a bit. As of the end of May, here are the chart of the short interest ratio (SIR) for the overall S&P 500 index:

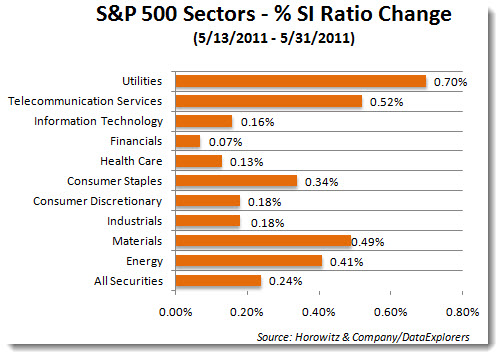

Of particular note should be the short covering of the sectors that have been beaten up and the laying out of new short positions on those that have had the trend in their favor. Looking back, this was obviously not a good move and is probably one of the reasons that the same sectors that had seen a decrease in short interest in the May 31st report, have been punished during the June downturn.