Yesterday was a nasty day for equity markets…on a global scale. Now we are starting to see a good amount of commentary that expects economic reports to remain weak, and possibly get worse. So much for being ahead of the curve guys!

Doesn’t it seem as though that once the press (especially the main-street kind) gets a hold of the story, it is way past the point of being timely. I mean, the promise of the internet was supposed to provide timely access to information. Obviously, no one ever explained that to the journalists. Or maybe the truth is that we should not expect anything different as the source of the information is (at best) suspect.

Just today, this was from page of Barron’s online:

Expect More ‘Unexpectedly’ Weak Economic Data

WOW! That is news? What happened to all of the silver-lining talk and weather related rationale that had been reason to put aside all of the “bad” news? What happened to the commentary about the Japan tsunami having no affect on global growth. What about the economic insight about how the high price of commodities will not bring down GDP growth?

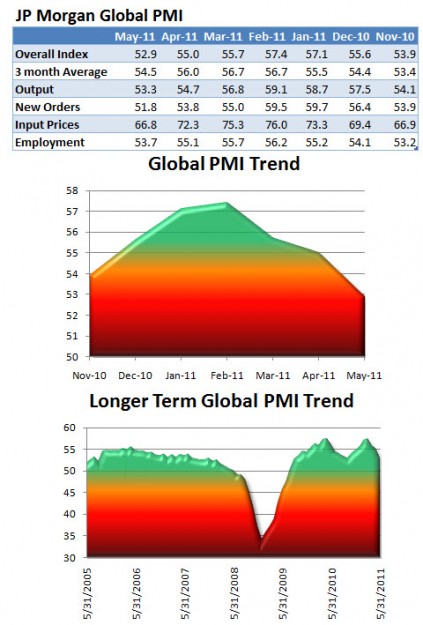

Instead, major brokerages are now cutting back economic estimates. JP Morgan cut U.S. GDP to about 2%, Goldman cut the NFP payroll expectations to 100,000 from 150,000+ and scores of others are reducing estimates.

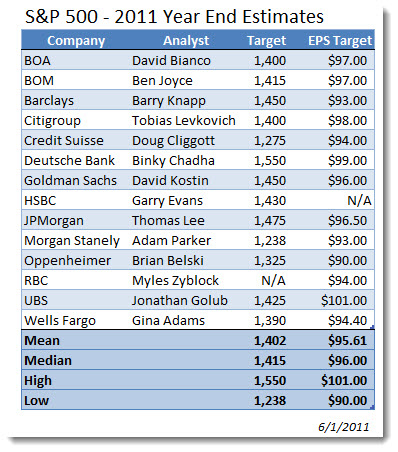

However, thus far there have been few that will back away from their prediction for the end of year value on the S&P 500. In fact, just today, Barry Knapp of Barclay’s reiterated his call for the S&P 500 to be at 1,400. Below are the major brokerage estimates as of today:

So far, it does not appear that the “big-boys” are willing to give up the fight. That is actually good. When and if they do, the complexion of the market will really change. Unfortunately, we will never know until well after they have sold a good chunk of holdings that they were not as bullish as they appeared to be – or until such time that they are ready to provide the information to their friendly journalist.

One more table and chart to consider…..