Ahhh. Don’t you just love a good day with the Fed? Who knows when the free flow of free cash will end?

As it appears from the most recent release, that may be a VERY long time. (VERY)

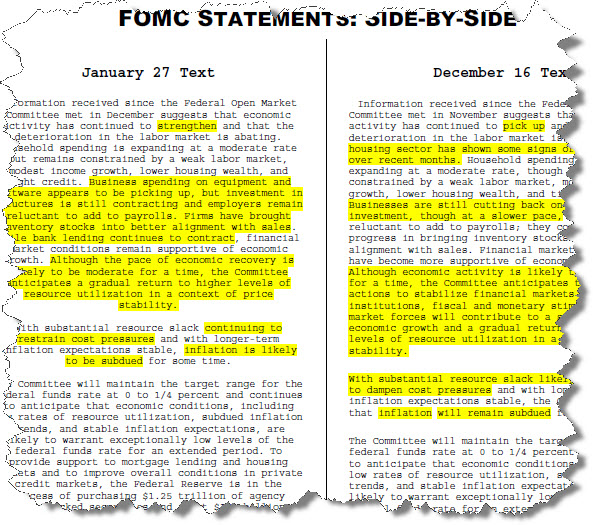

Even though there are dissenting votes, the most recent statement shows that the Fed intends to keep rates low and the stimulus pump in high gear. Actually, it does not seem to be any different than it was before the announcement.

Now all we need to get through the Bernanke confirmation, the grilling of the AIG bailout team, a financial industry overhaul, a health care initiative, inflation and we should be all clear to go back to life as usual.

Highlights….

- Business spending on equipment and software appears to be picking up, but investment in structures is still contracting and employers remain reluctant to add to payrolls.

- Firms have brought inventory stocks into better alignment with sales. While bank lending continues to contract.

- Although the pace of economic recovery is likely to be moderate for a time, the Comittee anticipates a gradual return to higher levels of resource utilization in a context of price stability.

- Voting against the policy action was Thomas M. Hoenig, who believed that economic and financial conditions had changed sufficiently that the expectation of exceptionally low levels of the federal funds rate for an extended period was no longer warranted

(Courtesy of Bloomberg Professional)

___

Disclosure: Horowitz & Company clients may hold positions of securities mentioned as of the date published.