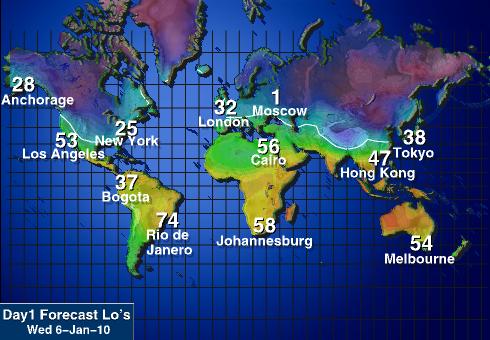

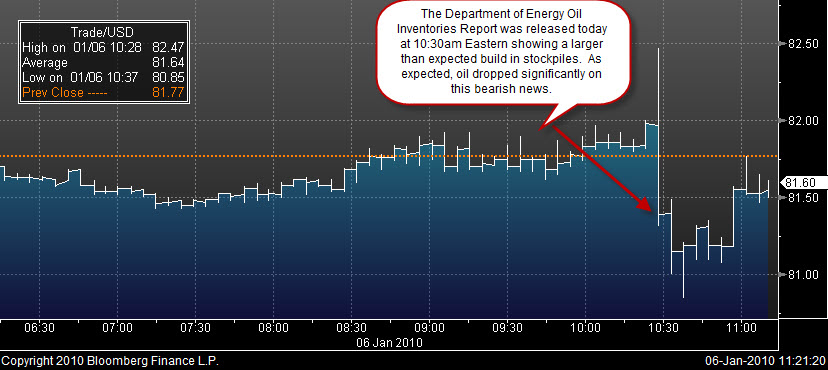

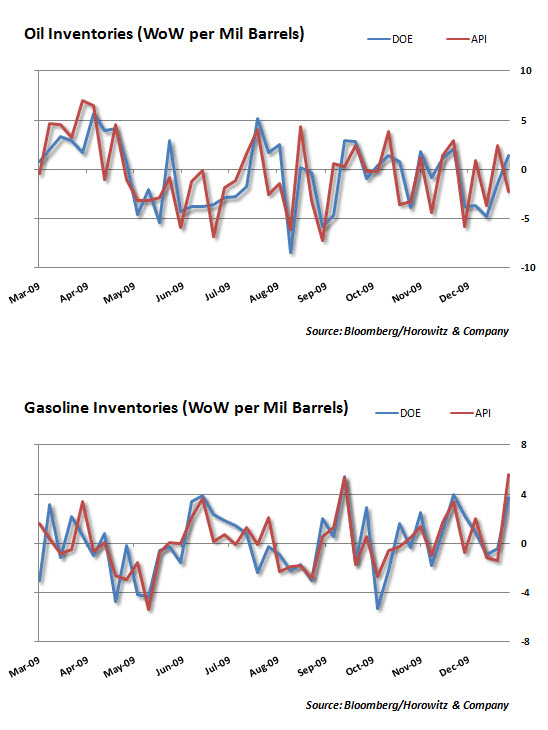

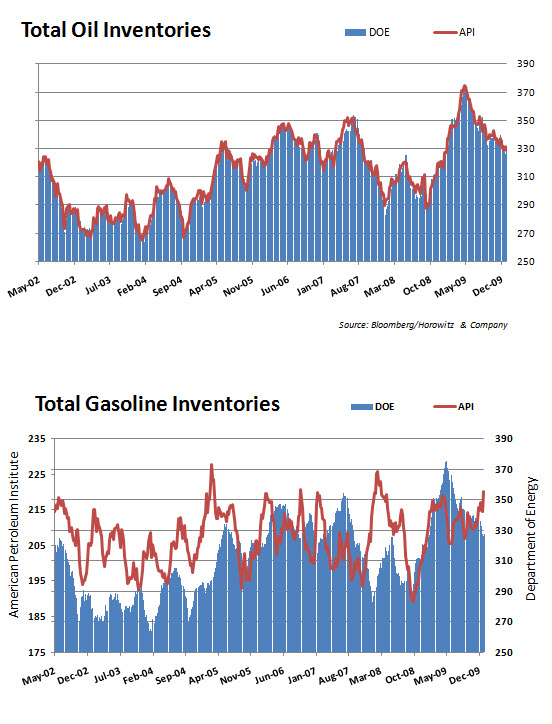

DOE Oil and gas inventories were released this morning. A much greater than expected build in gas and oil sent the price of oil down, initially. Again, there is thought that the cold weather will push up the price of crude and that there is a greater demand that may show up into 2010.

Now, if we look closer at the longer-term charts, we can see that there has been a draw-down of inventoriessince May of 2009. Traders are not focusing on the longer-term over the recent fundamentals as they are bidding up oil after this report. So, how high will oil go?

In the near-term, oil has been stuck in a range that tops out close to $82. As a hedge against our energy positions we have added a small position of the ProShares UltraShort DJ-UBS Crude Oil (SCO) as we see that the recent numbers show a change to the inventory and use levels. Moreover, the cold weather is just a temporary phenomena and should abate. (Note: This position will be cut quickly if there is a significant turn for Oil – As we know, oil traders are not completely rational about the fundamentals)

In the near-term, oil has been stuck in a range that tops out close to $82. As a hedge against our energy positions we have added a small position of the ProShares UltraShort DJ-UBS Crude Oil (SCO) as we see that the recent numbers show a change to the inventory and use levels. Moreover, the cold weather is just a temporary phenomena and should abate. (Note: This position will be cut quickly if there is a significant turn for Oil – As we know, oil traders are not completely rational about the fundamentals)

___

Disclosure: Horowitz & Company clients may hold positions of securities mentioned as of the date published.