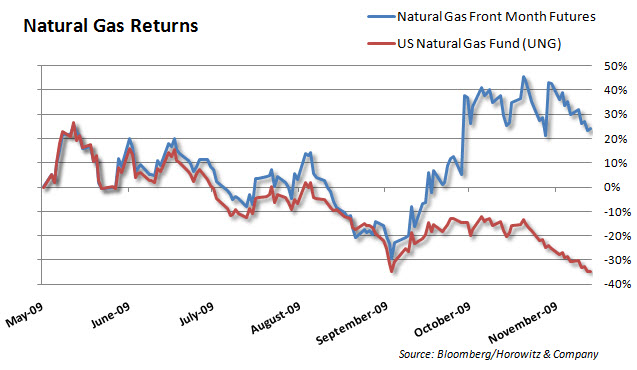

The chart below sure tells us what is happening with (UNG) – the biggest natural gas related ETF available. Look at the differential between the Natural Gas pricing (futures) and the ETF (UNG). We have written about this before HERE.

The problem is that there is an usually high level of contango with natural gas and this fund is caught in the crossfire. Also, the number of shares for this fund is enormous. That is a problem as the CFTC is trying to limit this. If you recall, the shares were no longer allowed to be issued not too long ago.

I am not sure of another ETF that is a pure play, but concede that while (UNG) does have some volatile ups and downs – you can still make money on it. Just remember that this is in no way linked to natural gas any longer as can be seen by the chart below. (May-09 to present)

It is unclear if this divergence will be resolved to where it was back in May-09. There are three schools of though here:

1) Reversion to the mean – (UNG) will come back in line with the natural gas pricing when (if) there is a the contango spread reduces to historic levels. This is how forex trading works if you are forex trading from Australia or looking for forex brokers from Australia.

2) This fund is just too big and because futures roll every month, there is no way that this can ever catch up. The unlimited number of shares that it can issue will hold it back as well.

3) Use it for trading only.

Thoughts?

__

Looking to invest in The Disciplined Investor Managed Growth Strategy?

Click below for the 14-minute virtual tour….

___

Disclosure: Horowitz & Company clients may hold positions of securities mentioned as of the date published.