If the markets were to be compared to a hurricane, we could say that the front wall has passed and we are now in the eye. This is one of nature‘s wonders that is both beautiful and potentially deadly.

During the period that the eye passes over, skies are blue, the air is calm and there is even a feeling of excitement that the storms is finally over and the damage is limited. But that lasts for a short time. It is usually the back end of the storm that causes the most damage. In fact, that usually has 20% more strength and has the potential to create tornadoes and eventual mass destruction.

Often times, market corrections can act in a similar fashion. Usually as an investor our first inclination is to prepare and see if we can weather out the storm and then as the volatility slows look to move back into the markets. Hopefully waiting enough time for the worst to be over. Then, sometimes, seemingly out of nowhere, the violent storm starts again. We have seen this cycle occur many times in the past. First we see indications, we prepare and then, just as the markets seem to be headed back up, we see a second break down. This is usually due to additional information being exposed or the result of investors re-evaluating risk.

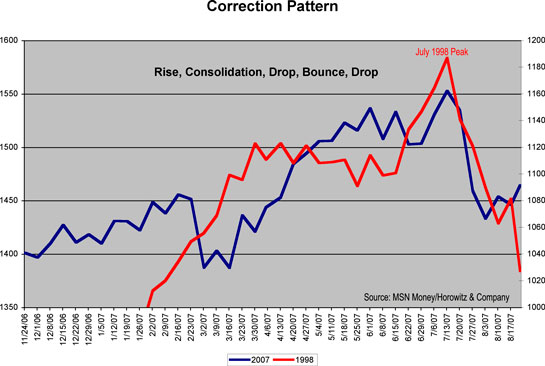

As the chart below shows (contrasting 1998 to today), a similar cycle was seen during the 1998 Long Term Capital Management fiasco. As the run-up in the market began to consolidate, the news of LTCM hit the financial markets. The initial downward move was fierce. Then, anxious investors, feeling more secure by the apparent containment of the event, looked to get in on a bounce opportunity and pushed the markets up for a few weeks.

Then, the second leg of the correction ensued, dropping out another 5% or so. While the past is no indication of the future, we should look and learn from some of the similarities and differences. The current environment is one that has fear, apprehension and uncertainty tied up a liquidity crunch. All of which wreak havoc on investments.

Be careful not to get your leg caught in a non-confirming bounce. Sometimes, a patient investor is a profitable investor. The fact is that we will not know whether we are in the EYE or if we just received a glancing blow. Prudence prevails.