Here is something that we never thought we would end up writing: We bought a small position into Natural Gas through an ETF (UNG) today. The fact is that there is a huge supply of natural gas and that does not appear to be abating. At the same time, the exploration and drilling throughout the world continues. Now, with that in mind, the real trouble is that there is still not enough consumption – even as the idea of enhanced usage is bantered about.

Then there is the problem with Contango. We have discussed this before as the reason that we believed that we would hold off investing in this commodity. But, as with anything, prices sometimes become out of synch with what is actually occurring from a supply and demand aspect.

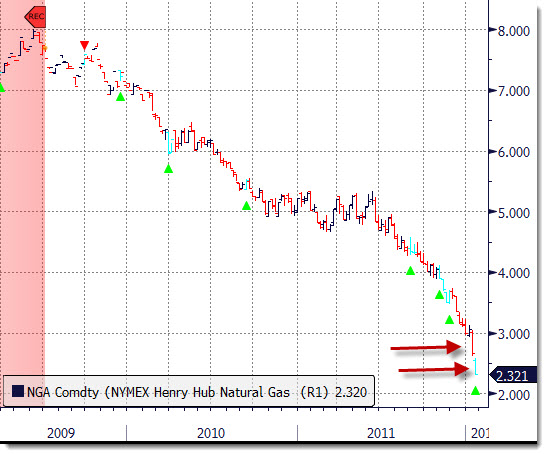

While this may not be the actual situation that is occurring now, it does appear that the last two weeks have provided a the look of a capitulation out of natural gas. Take a look at the chart below at the unruly action. The latest bars are screaming: GET ME OUT!

Now, that is often some of the better times to take a stab at an initial entry…(He said with trepidation)

Obviously this is not the breakout zones that we want to seek out as this is now uncharted territory. That said, there is a heap of short interest against this commodity and the gameplan seems to be “bust the shorts” of late…

Proceed with caution…. UNG price swings can get wild…