Levels of the CBOE Volatility Index (VIX) have been steadily creeping lower. Fear in our minds has certainly not subsided, despite the “Bazooka” introduced by Europe and the not so steady rise in equity prices. We haven‘t seen these levels of VIX (i.e. Sub 21) since July of 2011. As a matter of fact, the recent pattern in the VIX is very similar to that of what developed between May of 2010 until April of 2011. During this time period the market moved higher by approximately 25-30% after shaking out all the extreme volatility.

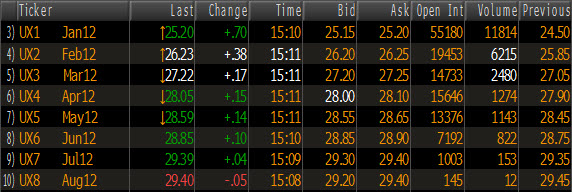

One could make the argument that with the unemployment levels improving and the Fed’s continued Zero Interest Rate Policy (ZIRP) that these levels are warranted. However, the spreads on the VIX Futures contracts paint a very different story. Most seem to be pricing in the fact that volatility will increase after the first of the year. As it stands, there is currently an almost 20% premium between the VIX Index and the front month futures contract that expires January 2012. The VIX index is currently trading at approximately $21 and the front month future is at $25.20. See table below for other futures expirations.