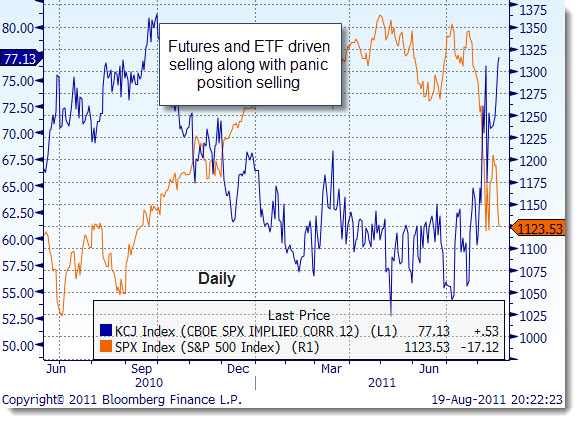

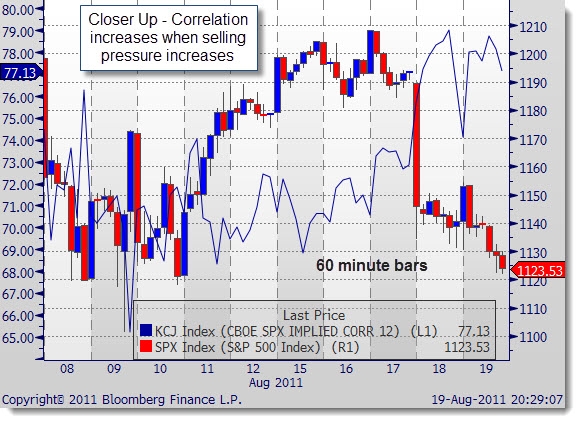

Over the past few weeks, the selling pressure has been growing. The recent 400+ point days for the DJIA (up and down) shows that there is panic selling AND buying occurring. Perhaps it is short covering helping to push markets up on the days when sellers take a break, but there is an interestingly high level of stocks moving lower during a selling wave.

That sounds logical, but what does it mean? First, the higher correlations could mean that there is a good deal of selling pressure coming from futures and ETFs. That may be in the form of short-selling or outright dumpling of long positions.

Second, it has the appearance that investors are looking to unload stocks with little regard for what they are actually selling. This would often occur in times of great fear and panic. Does that mean it is time to buy in as the phrase; “when there is blood in the street, it is a buying opportunity” states? Maybe and, maybe not.

Second, it has the appearance that investors are looking to unload stocks with little regard for what they are actually selling. This would often occur in times of great fear and panic. Does that mean it is time to buy in as the phrase; “when there is blood in the street, it is a buying opportunity” states? Maybe and, maybe not.

One of the key components in any game is to know your opponent. Selling that shows a high correlation of individual stocks sinking with indices can also be linked to hedge funds dumping positions as they are in the process of raising cash to meet margin calls. This was seen clearly toward the bottom of the 2009 bear market.

As volume has been enormous, the best explanation of what is going on is a mix of all of the above. The best strategy is to wait for a clearing (consolidation) that has the sustainability. If each rise in price is met with additional selling pressure, odds are that the selling cycle is not completed. Patience and planning will do investors well in this environment.