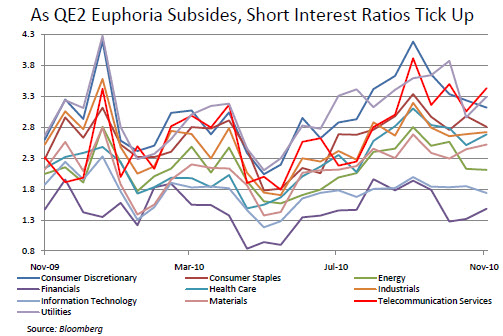

Short Interest on the S&P 500 has been creeping higher for many sectors since the announcement of QE2. The most obvious moves were in the Telecommunications Services and Utilities sectors, while there was a drop in Consumer Discretionary, Technology and Staples.

With the outlook murky over government tax planning as well as a political backdrop that is rather confused, this appears to be a defensive move that will come undone prior to the next earnings season.

Bloomberg’s Michael Mcdonough had this to say:

Investor confidence in quantitative easing‘s ability to bolster equity markets may have begun to fade. The short interest ratios rose for six out of 10 sectors in the S&P 500 in mid-November. This trend was also confirmed by an increase in short interest as a percentage of free float. The short-interest ratio, or the number of days it would take to cover all the short positions in a stock based on average daily trading volume, had been falling since mid-September after Federal Reserve Chairman Ben S. Bernanke‘s Jackson Hole speech, where he signaled a new round of quantitative easing.

A rising SIR implies more investors are shorting a security, or betting its price will fall. The S&P 500 rose 1.2 in the second half of November, while its short interest ratio climbed to 2.16 from 2.09 in the same period, according to data released last week. One potential market benefit of elevated short interest ratios is the potential for a short squeeze if market conditions begin to improve. A short squeeze occurs when a stock‘s price unexpectedly rises, forcing investors who are short the stock to purchase it to cover positions. That gives an additional boost. This likely helped bolster markets after Bernanke‘s speech after the S&P‘s short interest ratio peaked at 2.64 days. Rising SIR s may be a byproduct of the situation in Europe, and so long as uncertainties remain there, the amount of short interest in the S&P 500 likely will continue to increase.