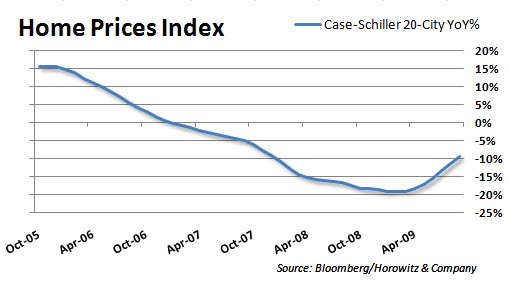

We are seeing a few numbers that are “headlining” well. For example, the Case-Schiller reported a 9.36% year-over-year decline. But, the declines are on top of declines that were already have seen. Of course we all knew there would be a time that show a slow-down of rapid declines that were occurring; or houses would be worth ZERO in no time. So, are we glad to see the drop slowing. BUT…

We are seeing a few numbers that are “headlining” well. For example, the Case-Schiller reported a 9.36% year-over-year decline. But, the declines are on top of declines that were already have seen. Of course we all knew there would be a time that show a slow-down of rapid declines that were occurring; or houses would be worth ZERO in no time. So, are we glad to see the drop slowing. BUT…

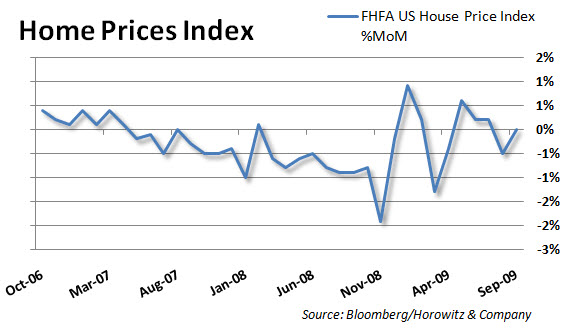

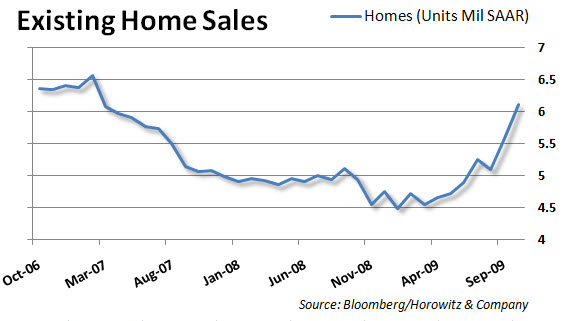

The fact is that all of the housing numbers will look better for the foreseeable future since last year’s fall was off the charts. Digging deeper into the report also shows that many of the existing home sales are still from distressed properties.

In addition, it has been shown that there is a trend that banks and mortgage issuers are allowing for those that are delinquent on their payments to either allow a lease-back of the property OR to have the mortgagee live in it the dwelling temporarily (free of payments).

Postponing a foreclosure is an interesting idea that will obviously kick the can down the road allowing for banks to build more of a cash cushion to weather the wave of Alt-A foreclosures that are coming. The real question is whether they will be able to handle the timing of that problem with the commercial real-estate implosion that will be arriving simultaneously.

For now, we close our eyes and cover our ears and hope for the best…

___

Disclosure: Horowitz & Company clients may hold positions of securities mentioned as of the date published.