President Obama spoke this morning about the relationship of the U.S. and China. Perhaps it was a simple olive branch as we have strained relationships of late. But, China has been flapping their mighty economic wings as they have shown an amazing amount of effort and success with their recent stimulus package.

President Obama spoke this morning about the relationship of the U.S. and China. Perhaps it was a simple olive branch as we have strained relationships of late. But, China has been flapping their mighty economic wings as they have shown an amazing amount of effort and success with their recent stimulus package.

A question that needs to be asked is whether President Obama is looking to hop on the China gravy train. It sure seems so as the speech was both an inferred apology to and request of China. If so, we much wonder if the speech was more of pleading for help as both economies are so tightly integrated. We won‘t go so far as to say that the U.S. is groveling for a handout (or should we?), but it appears that we are in need of China to help stimulate exports as well as their continued commitment to buying U.S. debt and their support of the dollar.

The latter is probably the greatest fear for the Treasury as we desperately need other countires to help pay for our record level of spending/backstopping.

Treasury Secretary Geithner was also in on the action today as he assured China that the U.S. is “serious” about shrinking the budget deficit. Is it any coincidence that today was one of the largest sales of government paper that we have ever seen?

Treasury Secretary Geithner was also in on the action today as he assured China that the U.S. is “serious” about shrinking the budget deficit. Is it any coincidence that today was one of the largest sales of government paper that we have ever seen?

The Treasury auctions today was said to be well subscribed. At least that was the headline used to make us fell warm and fuzzy about the auction. But here is a little tidbit about the demand that may cast a different light in the subject: (Bloomberg)

“The U.S. Treasury has raised $1,020.043 billion in new cash this year selling Treasury securities. The Federal Reserve has purchased $219.721 billion in Treasury securities, or

21.5 percent of the new cash raised in 2009 by the Treasury.”

Hmmmm. That is interesting, No?

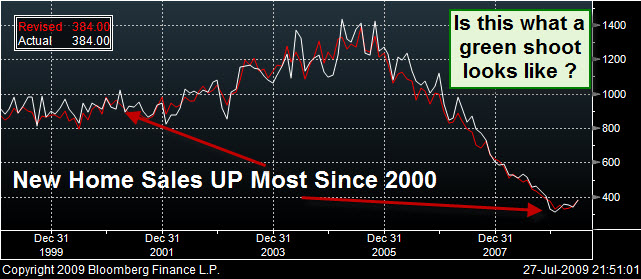

But, the housing data was the topic of the day in terms of economics. There was a high level of optimism that we would see a good number today and by golly, that is what we had. Initially, markets snapped higher on the news after trading lower earlier. On cue, the DJIA, S&P 500, Oil and the NASDAQ broke toward positive returns for the day almost immediately. Then, after the initial 10 minutes of joy wore off of the reactionary investor, we watched the news driven rally fade back below the pre-news levels.

What were the numbers and why the .66% move up and then down for the equity markets? Well, as we know, these days it is buy/sell first and ask questions later.

The numbers: 384k new homes sold in June vs. 346k in May. That amounts to an 11% increase in new homes sales as opposed to a 2.4% increase in May. This is all good even as much of this is due to the low mortgage rates and the first time buyer credit as well a a season that usually brings in buyers.

To take the other side of the discussion for a moment, even with the higher sales, median prices for new homes were down and that this is concerning the markets. Perhaps investors are wondering how sales at rock bottom prices today will affect overall stabilization of home prices into the future. (We will see more detail for this tomorrow as the Case-Shiller housing report will be released at 8:00am)

As most have come to realize, the diminishing prices continue to push up foreclosures and reduce wealth. Without a rise in housing prices, more people will be pushed to the brink of bankruptcy as their balance sheets continue to tilt toward higher debt. (Of course, I would like to point out that CNBC reported these numbers incorrectly by showing prices on a year over year basis as up 12%, when they were actually down 12%. (Cheerleading at its best/worst?)

Higher debt is not in the best interest of the consumer who relies on credit to fund their lives. No, that is not a financial plan that we approve of or suggest since it is precisely what has created the credit mess for which we are now attempting to unwind. Somehow, someone, anyone needs to spend a few minutes re-training the U.S. consumer/saver to understand that the future cannot, and will not be a free ride paid for by the government.

We say this not to stir the pot or to look down on socialized payment systems but to point out the fact that we are on a slippery slope if most believe that their future is secure without personal savings. To their credit though, we are seeing a significant increase in the U.S. savings rate over the past year. This is a good trend that will hopefully continue, as this will be the best path toward personal balance sheet recovery.

Only once the balance sheets are reconstructed through a painful de-leveraging process will we have the resurgent of the consumer. That is not nearly the case yet. No, while we see many retail stocks continuing to move higher, especially electronics and technology based operations; most are doing so by cutting expenses and whittling down inventory in order to benefit the bottom line.

Some would argue that this is a process that can continue for some time as the benefit of technology assisted sales and supply chain management is the next frontier to stabilize net profits. If you recall, we have talked about this in several TDIMG post and TDI Podcasts of late.

The main takeaway from the above commentary regarding the balance sheets and the price of homes is that we are still not out of the woods with regard to real estate. 8.5 months of inventory is better than it was, but again it is not a good number. Add to that the commercial real estate loans that will be coming due within the next 12 months and we need to realize that the financial system will continue to be under duress for some time.

The one “bright light” in all of this is the fact that every aspect of the financial markets has a partner ready and willing to backstop losses. Remember, the partner is not so silent as they have the ultimate power to create a positive PR campaign. Spreading money to almost every corner of the U.S. business market, our government has become the lender of first and last report.

One item that needs to be addressed again today is the tightening correlation of the global markets. Once again, we saw Asia and Europe up prior to the opening of the U.S markets. German consumer confidence was also up. We also saw a few bank earnings helped to boost European markets. Then, even as European markets were showing gains of 0.6% to 1.4%, losses were quick to follow once the U.S. markets opened.

This is really not a good trend as global herd investing can drive markets higher and just as easily lower. The recent 2-weeks of gains will be under pressure if sentiment changes, even in the face of earnings beats. The herd will either win or lose together. Just as it is in the wild, if the stampeding herd is coming, stand aside so not to get knocked over. Once the herd rests though, look to join in….

Disclosure: Horowitz & Company clients may hold positions of securities mentioned as of the date published.