OK, you hit a nerve. I can’t hold back any longer simply biting my tongue. I apologize in advance.

According to Paul B. Farrell, the money losing lemming of Marketwatch’s Lazy Portfolio strategy, it is a good thing to do nothing with your investments as they lose and lose big…

According to his latest brilliance:

And it’s so simple and easy. No Wall Street. No active trading. No stock-picking. Just buy and hold a well-diversified portfolio of three to 11 low-cost no-load index funds, all based on the Nobel Prize-winning Modern Portfolio Theory.

If that is not the most idiotic thing that I have heard in 2008, I don’t know what is. To actually come out and publicly boast that you have a winning strategy that entails no work and proud of the fact that you helped people lose more than 1/3 to 1/2 of their portfolio values takes some real nerve.

(See how we manage portfolios HERE)

What is it with these people anyway and why are they allowed to write such reckless dribble? I suppose that is is okay now to write about how easy it really is to work a Ponzi Scheme.

Mr. Farell, here is an idea for your next article: The Ponzi Portfolio: Simple! No Office. No Boss. No Research. Just tell people they are making money over and over because of a secret formula, all based on the Bernie Madoff Theory of investing. (At least Bernie made gains for his investors, even though they were fake)

And, you can keep telling everyone that you are beating the S&P, even though they are losing massive amounts of money. Ridiculous you say? No more than your Lazy Portfolio idea.

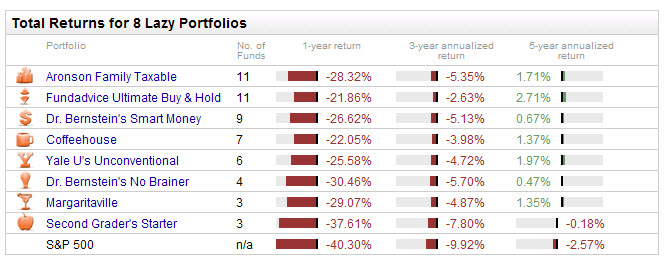

The article goes on to show just how absurd this Lazy Portfolio is:

So I asked the creators of the Lazy Portfolio what’s ahead. Well, nobody’s panicking: Not one is changing asset allocation for 2009.

Why change? If it is okay to lose 30% or so, what is the difference. Eventually they will get it right.

It is all about the S&P 500. Why? Seriously… Why? How about the thought of beating the benchmark of ZERO. I thought the idea was to make money when we invest, not be satisfied with simply beating an arbitrary index.

Yes, the Lazy Portfolios were down in 2008. But all eight Lazy Portfolios are beating the benchmark S&P 500 by anywhere from three to 18 percentage points. Plus the five-year averages for seven of the eight are in positive territory and the S&P 500 is not.

The real kicker (assuming you have not thrown up yet) is that the comparison is not apples to apples. While it is fine to look at the S&P 500 as a comparison of a portfolio based on equities, there are several funds in your portfolios that invest in fixed income. If you were to look at those in relation to the S&P 500, how would they have compared?

Once again, a slight of hand to try to make their failure look good to an unsuspecting reader. Remember, even the 6’1″ fella looks short next to a 7’10” gent. It is all a matter of perspective.

Mr. Farrell: RETIRE PLEASE!!!!! Then you can be lazy all day. Why should you work so hard at proving that you have found a winning formula, when you don’t?