American Funds has recently put out a concerning report on their website. It is aimed at advisors who are looking for ways to approach their clients to help smooth over any hard feelings from the pain and harm inflicted during 2008 on buy-and-hold mutual fund portfolios.

My first question is: Where were they 6 months ago to help mitigate the apparent disaster that was coming? Too harsh? Okay, let’s give them some slack…how about 2 months ago?

My first question is: Where were they 6 months ago to help mitigate the apparent disaster that was coming? Too harsh? Okay, let’s give them some slack…how about 2 months ago?

Take a look at the “high-end” process being used to bring investors back into the market. Essentially, it appears that investment professionals need to be to spend some time with their clients to discuss what happened, find out what questions they may have and once that is accomplished, magically restore confidence. This expertly designed plan will some how provide the peace of mind to help sell more fund shares investors put more money to work. (I can hear them now: Get your red hot front-end load, only 5.75% charge while supplies last!)

Here is their magic formula:

We realize this year‘s annual review will be a crucial meeting for you and your clients. As you prepare for and conduct these meetings, we hope you‘ll find the 4-Step Process for Client Reviews helpful in addressing your clients‘ concerns and rebuilding their confidence in the investment markets. In this piece we identify American Funds resources and online tools you can use to guide your clients through each step. These four steps include:

1. Identify concerns and questions.

2. Provide market perspective.

3. Restore confidence.

4. Implement opportunities.Depending on the client, you may want to devote time to go over the broad investment perspective during your annual reviews.

Then, they provide a few “educational resources” that can help with client discussions.

I suppose that #3 is accomplished once the advisor states with confidence: “Everything will be alright.” (See Placations for a Financial Crisis: The Planner’s Handbook) Is it me or is this just a lame attempt to sell more stuff?

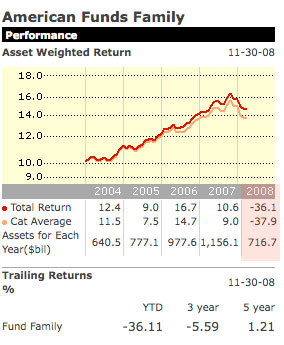

Morningstar snapshot for the American Funds Family. Truth be told, I actually like the group, as their hybrid multi-manager approach has had done an excellent job for investors – Until 2008 of course.

Comments please: How does this make you feel? Do you think that this is a plan to restore investor confidence or just another sales job?