* Recently, we bought U.S. Natural Gas Fund (UNG) for The Disciplined Investor Managed Growth Strategy portfolios…

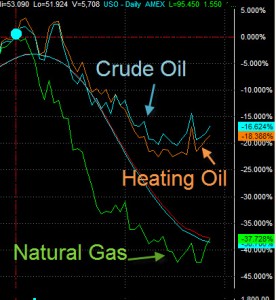

Below is an interesting graphic that shows the effect on energy commodities by the legislation that closed the Enron Loophole. Even though there has been a great deal of discussion concerning the supply and demand factor, specifically related to China, it is clear that since July, the precipitous fall of energy commodities is not due to a reduction in demand. Supply/Demand had little to do with what occurred. It was rampant manipulation and speculation, and this graphic provides more proof.

The chart shows the percentage change of the three energy related ETFs (funds) that track natural gas, crude oil and heating oil. Of those, natural gas has fallen the greatest amount (37% down) as is appears that it is not the main target of speculators any longer.

Basically, even as there are arguments showing that there is plenty of supply of natural gas, the demand for cleaner burning fuels should continue to grow. Demand should continue into the future. Although now it may be at a more normalized pace. So, the timing looks right to begin to enter a position of UNG at these levels.

From my recent MSN Strategy Lab commentary:

All that aside, it still seems likely that clean-burning fuels will be much sought after and natural gas is going to see increased demand. After climbing more than 50% from January into July, United States Natural Gas Fund has dropped just as fast. Now resting just off its consolidation levels, natural gas prices have fallen 30% since the so-called “Enron loophole” was closed for natural gas and heating oil. This is now a demand play, and I’m adding it to provide diversification to my Strategy Lab portfolio and hedge the potential for runaway energy prices.

(Click chart to enlarge)

UPDATE: We sold this position via a sell-stop later the SAME day the position was entered. (7% sell-stop was applied on purchase)