The only thing worse than running out of Turkey on Thanksgiving is talk about cutting dividends on stocks. This is nothing to take lightly. It ranks up there with yelling fire in a theatre and is almost as bad as telling investors that they cannot withdraw money from their accounts. The recent flurry of negative news concentrating on the financial sector has investors running for cover, as they are apprehensive about what else could lurk beneath the surface. Of course, that point is relatively clear to most. What may not be so apparent is what financial firms will do in their desperation to help defray costs associated with their frolic through Hell‘s Gate, now better known as the mortgage business.

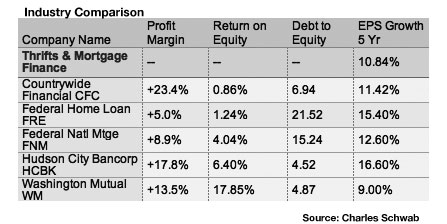

It is very troubling to find that the “shoes dropping” are not showing any signs of abating. In fact, it seems that the number of shoes related to the problems in the financial sector can only be matched in quantity to those found in the closets of Imelda Markos. The truth is that this recent announcement by Federal Home Loan Corporation, aka Freddie Mac (FRE) a traditional and conforming lender is much more significant as now, it is known that the spread of the sub-prime problem has seeped into areas which were not anticipated by most analysts.

Direct from the pages of the Freddie Mac website: “as of September 30, 2006 held a $3 billion cushion over the OFHEO mandatory target surplus.

This is real, permanent, at-risk capital that provides the first line of defense in the unlikely event of a financial catastrophe at Freddie Mac. Since shareholders are the ones providing the capital, they and not the taxpayers will be the ones to bear the losses. Shareholders expect an adequate return on their investments in exchange for putting their money on the line, but like any other investor, they buy our stock at their own risk.”

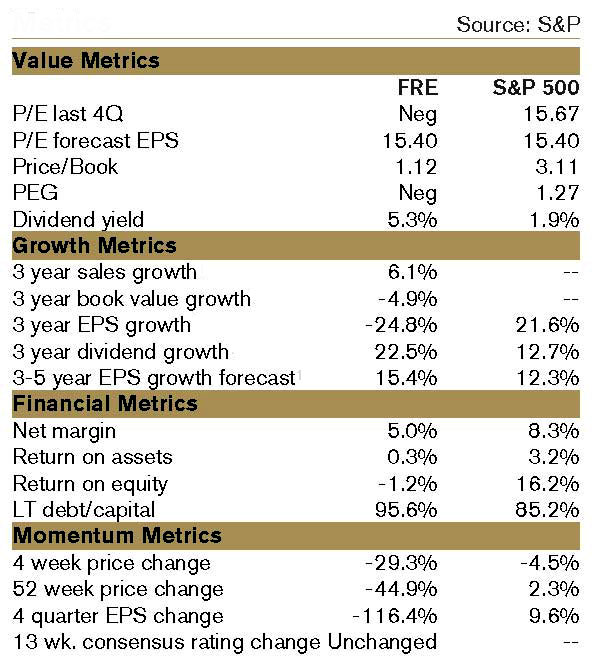

According to reports by the company, Freddie Mac saw the fair value of its net assets decreased by about $8.1 billion in the third quarter. Freddie Mac has also hinted at the possibility of the cutting their dividend in a defensive move to protect the required level of capital surplus requirement imposed by regulators. A cut to their dividend would immediately help to stem the reduction of assets due to their ailing portfolio; but whether it is significant enough is yet to be seen.

With 661 million shares outstanding, a 50% cut in the common share dividend could save the company $661 million or so annually. This would bring the yield down for current shareholders, but keep it at reasonable levels for new investors. Yet, that will not offset the ancillary problem of the reluctance by many to buy their debt; even if the ratings remain high. The combination of investor mistrust of corporate guidance along with a poor record by the rating agencies will not bode well for any coming offerings by FRE. Realize that the market has a unique way of self-assessing and even if the rating maintains strong, the fact is that investors will require a great deal more yield for the risk involved in this position.

With 661 million shares outstanding, a 50% cut in the common share dividend could save the company $661 million or so annually. This would bring the yield down for current shareholders, but keep it at reasonable levels for new investors. Yet, that will not offset the ancillary problem of the reluctance by many to buy their debt; even if the ratings remain high. The combination of investor mistrust of corporate guidance along with a poor record by the rating agencies will not bode well for any coming offerings by FRE. Realize that the market has a unique way of self-assessing and even if the rating maintains strong, the fact is that investors will require a great deal more yield for the risk involved in this position.

As this story unfolds, news and speculation regarding how the company will replenish some of the assets and bring in new money to provide for its continuing operations are looking towards the potential issuance of billions of preferred stock. The problem rests in the fact that while there are usually more liquid than traditional bonds, there is no guarantee that the company will make about repayment of the principal. Why would anyone look to enter a position if they had all of that information at hand?

What happened with the Analysts?

Over the past several months the 15 analysts covering this stock (as reported by S&P) have seen fit to keep their ratings of the stock constant. According to published reports by Standard & Poor‘s, the monthly trend has not changed since August.

15 Analyst Ratings (August-November)

Buy – 3

Buy/Hold – 3

Hold – 9

Unless HOLD is the new code for SELL, then they had it slightly wrong. Furthermore, these same analysts are estimating a 73% increase in EPS through 2008. Suffice it to say that these estimates “may” be have been slightly aggressive.

The outlook is not bright for a swift recovery, even if the Fed looks to cut rates or inject additional liquidity. The real issue is what is going to be left of the domestic financial system if a significant overhaul is not massive and immediate. Once again, the weak dollar combined with excessive spending and pathetic oversight on the part of this administration has made our economy more vulnerable than it has been in decades.

This is not the same problems that we saw in 1999-2002. No, that was a market event predicated on the fact that massive and unrelenting speculation allowed for stocks to overheat and the adjustments made by the Fed were more market-based that economically centric. Today, there is a cancer eating away at the core of our financial system and it is rooted in greed. Once again, derivatives, fancy packaging of financial securities along with a heavy dose of corporate mis-guidance has provided for disastrous results.

Buy and Hold will be the only saving commentary after there were so few willing to step out and tell us all what was really going on. Now investors are left to lick their wounds and hope that the economy is able to sustain this direct blow. Remember, if we compare the technology sector to the brains, we can then think that that the financial sector is the heart. The heart that pumps all of the necessary components throughout the entire system, allowing for it to work.

This RANT in all of its glory can be heard on The Disciplined Investor Podcast – Episode 35

Note: Horowitz & Company clients are not long or short any positions mentioned as of the date of this post.