There is a good deal to be concerned about ahead of some EU decisions tomorrow. Add that to the parade of Fed officials talking about the potential for a revision to U.S. growth and that can take the wind out a rally real quick.

Then there is the Euro. As the region grapples with what they need to do with Greece and the other debt ridden countries, we are starting to see some cracks in the short dollar/long Euro foundation. As noted in previous discussions, this has been a rather crowded trade and if the herd reverses, it will be a stamped. This trade has also been a dominate factor in the commodity play, so what is good for one is good for the other.

More importantly, the yesterday’s speech by Bernanke and today’s Beige Book was not taken well.

From Briefing.com:

Reports from the twelve Federal Reserve Districts indicated that economic activity generally continued to expand since the last report, though a few Districts indicated some deceleration. Some slowing in the pace of growth was noted in the New York, Philadelphia, Atlanta, and Chicago Districts. In contrast, Dallas characterized that region’s economy as accelerating. Other Districts indicated that growth continued at a steady pace. Manufacturing activity continued to expand in most parts of the country, though a number of Districts noted some slowing in the pace of growth. Activity in the non-financial service sectors expanded at a steady pace, led by industries related to information technology and business and professional services.

The finer details of the report:

- Fed Says Credit Standards Were `A Bit Easier In Recent Weeks’

- Fed Says Manufacturing Activity Rose In All But Two Districts

- Fed Says `Wage Growth Generally Remained Modest’

- Fed Says Labor Markets Improved Gradually In Most Regions

- Fed Says `Widespread Improvement’ Reported In Credit Quality

- Fed Says Economy `Generally’ Grew While Slowing In Some Areas

The mood has been rather nasty lately, yes -but the last couple of days really put the icing on the cake. If there was some hope that the market morass can be lifted, it will have to wait for another day… Perhaps there will be something that will be seen in the Trichet comments ( assuming that he says something the markets will like as his back is against a wall right now. If he signals tightening, the dollar drops and commodities rise – not a good combo….)

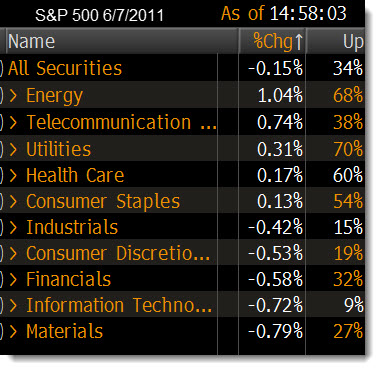

So, while there was a DJIA that held up strong, that was not the case for the majority of stocks. The pile may look nice on the outside, but it stinks on the inside.