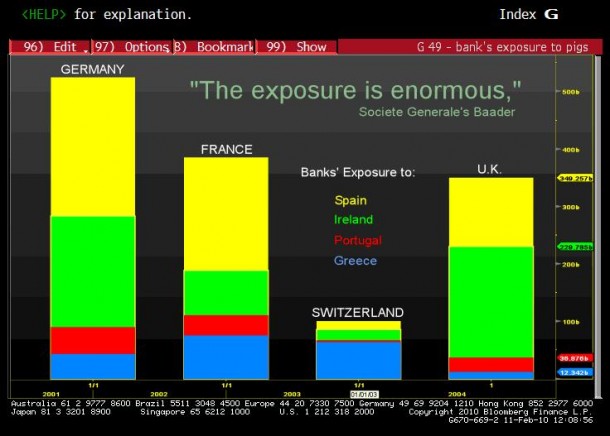

So, just how much exposure are we talking about here and who is at most risk? Clearly it is concentrated in the EuroZone and a major amount is slanted toward Germany and France.

The chart below helps to explain why both German and French leaders have been working so hard at calming investor fears as they are heavily loaded with the toxic sovereign debt. And now that we have moved from a private debt panic backed by governmental (aka taxpayer) backstops to a sovereign debt crisis there is only one question…

Who backstops the defaulting sovereign debt? If we go up the ranks, it must be a something much more powerful and much more stable…. Could it be that we are to look toward the heavens for the next bailout?

Perhaps we will need to ask those that do “Gods work” and see how much is available from the SMF (Saintly Monetary Fund).

Thoughts? Comments? Outrage?

From Bloomberg:

German and French banks‘ “enormous” exposure to Portugal, Ireland, Greece and Spain explains why Europe‘s biggest economies are moving to rescue their southern neighbors, Societe General SA said today in a report titled “Shotgun Greek Wedding.” The CHART OF THE DAY shows how much money German, French, Swiss and U.K. banks have at stake in the so-called PIGS countries. Banks in Germany and France alone have a combined exposure of $119 billion to Greece and $909 billion to the four countries, according to data from the Bank for International Settlements. Overall, European banks have $253 billion in Greece and $2.1 trillion in the so-called PIGS.

“The exposure is enormous,” said Klaus Baader, co-chief European economist at Societe Generale in London. “The crisis in Greece isn‘t Greece‘s problem alone but a concrete problem for Europe‘s whole banking sector. That explains the interest of finance ministers in stabilizing the situation.”

Leaders from the 16-nation euro area said today they have agreed to act if necessary to help Greece reduce its budget deficit and safeguard financial stability in the region. Debt-stricken Greece is struggling to convince investors it is able to reduce its deficit from 12.7 percent of gross domestic product, sparking turmoil on financial markets.

Spain, Portugal and Ireland, also suffering from gaping deficits after the worst recession since World War II, have been sucked into the swirl of widening bond spreads and soaring credit default swaps. The premium investors demand to hold 10-year bonds of the so-called PIGS countries instead of benchmark German bunds, and the cost of insuring against default, have

surged this year.“The countries‘ situations put the finances of fiscally stronger countries in jeopardy,” Baader said. “That‘s one reason why the tone changed.”

___

Disclosure: Horowitz & Company clients may hold positions of securities mentioned as of the date published.