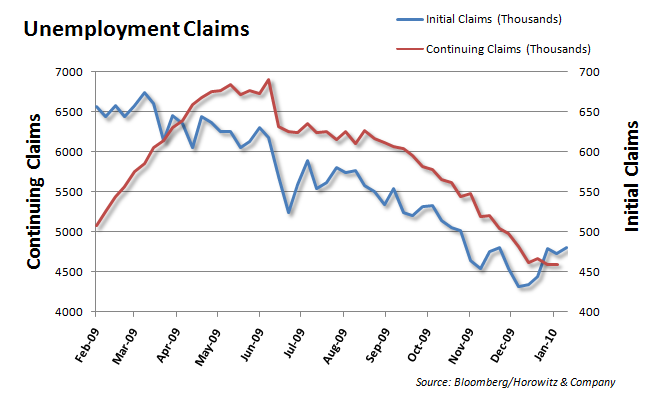

No one was happy to hear that the initial claims ticked up again this week. Sure we are much better than back in March, but we cannot put aside that there are many spots of crabgrass sprouting up amongst the newly laid sod.

Moreover, the continuing claims also moved higher using the “old” metrics that do not include the emergency and extended benefits.

- Initial Claims 480K vs 455K consensus, prior revised to 472K from 470k Q4

- Nonfarm Productivity – prelim +6.2% vs +6.5% consensus, Q3 +7.2%

- Continuing Claims rise to 4.602 mln from 4.600 mln.

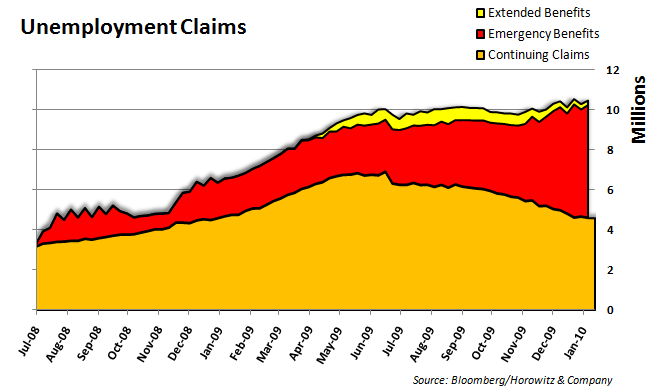

Below is a chart that clearly shows all of the continuing claims in one nice neat package. Once again these are record setting numbers. Unfortunately not the kind of records that we want to see.

What will it take to stop the job losses? More spending? No way as the price tag is obviously more taxes that will squeeze the small business and that has (and will always be) the center of job creation. And let’s face it, shovel ready is not so ready anyway. Another jobs initiative is on the way which will probably get tied up in Red-Washington-Bureaucratic-Tape, the stickiest tape ever invented.

___

Disclosure: Horowitz & Company clients may hold positions of securities mentioned as of the date published.