It seems that there is more than one cliff when it comes to the global economies these days. Green Shoots are turning to Green Ooze right before our eyes. Yet, no matter what the news, stock markets seem to like that there is…well news, I suppose.

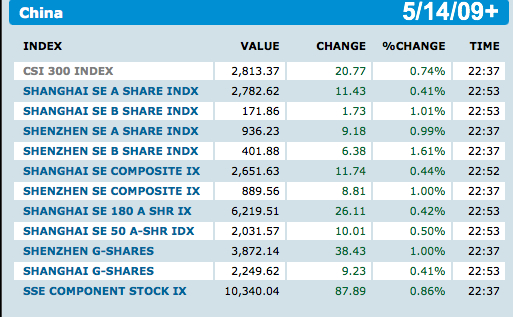

Here is an sample of a data point that should have been cause for consternation, yet China markets are moving higher overnight.

Investment dropped 22.5 percent to $5.89 billion in April, the commerce ministry said at a briefing in Beijing today. That compares with a 9.5 percent decline in March. For the first four months of this year, spending fell 21 percent to $27.67 billion.

The comment by Mr. Cohen that is nothing more than information we have heard a thousand times since the November stimulus package was unveiled by Premier Wen Jiabao. This is a NEW data point, isn’t it?

Full text of article:

May 15 (Bloomberg) — Foreign direct investment in China fell for a seventh month from a year earlier as companies cut spending to weather the world‘s worst financial crisis since World War II.

Investment dropped 22.5 percent to $5.89 billion in April, the commerce ministry said at a briefing in Beijing today. That compares with a 9.5 percent decline in March. For the first four months of this year, spending fell 21 percent to $27.67 billion.

Premier Wen Jiabao‘s 4 trillion yuan ($586 billion) stimulus plan may counter weaker investment by Chinese and foreign companies and revive the world‘s third-biggest economy. Spending on factories and property surged 30.5 percent in the first four months and new lending climbed to a record, data this week showed.

“This is a reflection of multinational companies around the world tightening their belts,” said David Cohen, an economist with Action Economics in Singapore. “The weakness is being offset by the fiscal stimulus measures of the Chinese government.”

Businesses that are partly or entirely foreign owned account for 30 percent of industrial output, 55 percent of trade and 11 percent of urban jobs, according to the commerce ministry.

“The decline is in line with the global economic crisis, showing the effect of the world recession on investments,” commerce ministry spokesman Yao Jian said at a briefing in Beijing.

Currency Gains

Besides the credit crunch, investors‘ reduced expectations for the yuan to appreciate are discouraging inflows of capital, according to Wang Tao, an economist at UBS AG in Beijing. She expects “smaller but sizable foreign direct investment inflows in 2009, with a continued rise in Chinese investment abroad.”

The government has stalled gains by the currency against the dollar since July last year, aiding exporters of toys, clothes and electronics after global demand collapsed.

China recorded a 40.6 percent drop in new registrations by foreign companies in the first quarter from a year earlier, the State Administration for Industry and Commerce said in a report released this week.

Not all companies are holding back on investment as the government spurs demand by providing subsidies for purchases of vehicles and home appliances.

Volkswagen AG, the biggest overseas carmaker in China, and its local partner, China FAW Group Corp., will invest 550 million euros ($737 million) expanding capacity at a plant in western Chengdu city, the Chinese automaker said May 8. China‘s vehicle sales have topped those in the U.S. this year.