Thursday April 10, an article posted by Morningstar’s Ganesh Rathnam discussed some wonderful ways to profit from selling PUT options against the shares of Capital One (COF) as the author believes that the market has it wrong. Remember, the analyst is suggesting a bullish strategy.

Here are the highlights of the analyst’s report and a few comments:

We believe these fears are overblown. Capital One, in our opinion, has all the tools to fight these fires. Ever get notices from your credit card company warning you of a stiff impending rate hike? Well, there’s Capital One’s first tool: its ability to reprice loans almost at will to meet higher credit costs. It can also raise fees and change the minimum required payments on cards so that consumers must pay off their loans faster.

So, Mr. Rathnam, Capital One should just abuse their current customers and demand that they pay for the problems associated with the remainder of the company. Wow, I do not want to be your client! Also, have you noticed that there is pending legislation to stop these types of egregious practices? And one more thing…. kindly see this little item about COF capping fees for cardholder. Maybe you missed this piece that discusses how Capital One is freezing the variable rates on some card and converting them to fixed.

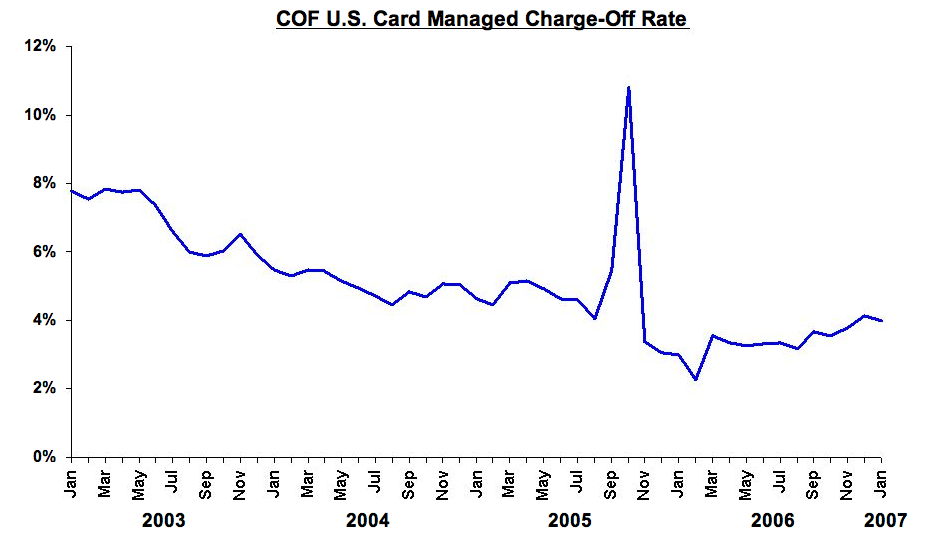

After the acquisition of two banks, North Fork and Hibernia, only 44% of the company’s managed loan portfolio consists of credit card receivables, compared with nearly 100% a few years ago. Additionally, Capital One has a history of writing high-quality loans and managing credit risk. In fact, net charge-offs have trended lower in each of the past four years, declining to 2.88% of managed loans in 2007 from 5.86% in 2003

Charge-offs trending lower? What information are you looking at? The latest report released yesterday shows a 13% increase in charge-offs since December, 2007. Moreover, you should know this: Charge-offs decline during economic expansions. We are in a totally different market condition now. Also, write-offs PEAK just prior to an economic recovery. The latest 8-K reports charge-offs are 4.11% for managed and 5.46% for national lending. (Credit card segment notching up to 6.54%)

Question: Wasn’t 2003 the start of the recover? Isn’t 2008 the beginning of the decline? With respect, I believe you should revisit Eco 101 class. I will not get into the fact that there is a clear uptrend going on. (Chart courtesy of Capital One investor meeting March 2007)

Even accounting for a more diversified loan book, we believe the bank has maintained strict underwriting standards during the credit bubble. Therefore, despite credit cards being unsecured loans, we believe mass defaults are improbable. After all, consumers in financial trouble can walk away from the negative equity in their homes and move into an apartment, letting the mortgage holder take the loss, but they still need to eat and drive to work, and their credit card is their lifeline to that spending. Therefore, they have the perverse incentive of remaining current on their credit card accounts while losing their house.

Defaults improbable? Where is the money common from to pay the bills? How out of touch you are with what is going on down here with us common folk. Give me some cake, please…

In addition, unlike in mortgage securitizations, credit card companies have skin in the game beyond the retention of a small portion of the value of the loans they securitize. Though the credit card companies report financial statements on an “owned” basis–loans and residuals of securitizations retained on the balance sheet–they run their business on a “managed” basis; i.e., they assume that they own all the credit card loans that they originated and pretend the proceeds from securitizations are actually their own debt.

Each card securitization trust has ample credit enhancements such as over-collateralization–for example, $120 of loans backing $100 of obligations–so purchasers of the trust’s notes feel safe and charge lower interest rates to loan money to the credit card company. In exchange, the company gets to keep the excess interest over what these investors charge, but, of course, only after accounting for loans from credit card customers who default on their cards. Therefore, it is in the company’s best interest to maintain underwriting standards because it pays for charge-offs out of its own pocket. These unique aspects of the credit card business–the alignment of incentives between the credit card company and the buyers of the credit card loans–are why the credit card securitization market remains largely unaffected despite the turmoil in other asset-backed securitization markets such as residential mortgages, commercial mortgages, and auto loans

YIKES!!!! That is one of the largest problems… That off-balance sheet item ($49bln) has a default rate of 5.8% where the base portfolio is 3.26%. What are you looking at? Is it possible that the recent 12 months of reports from the company have not made it to your desk? I really do not understand…enlighten me….please!

See more about the 8-K in an article I wrote for AOL Blogging stocks yesterday.

Also see a more details discussion of the Capital One Problem here.

Disclosure: Horowitz & Company clients are SHORT COF as of the publish date.